Buying Time

Solving for time preference.

In today’s article, we explore a method that allows us to buy and sell time itself.

A Convoluted Method

Without getting too technical, we have to understand some mechanics.

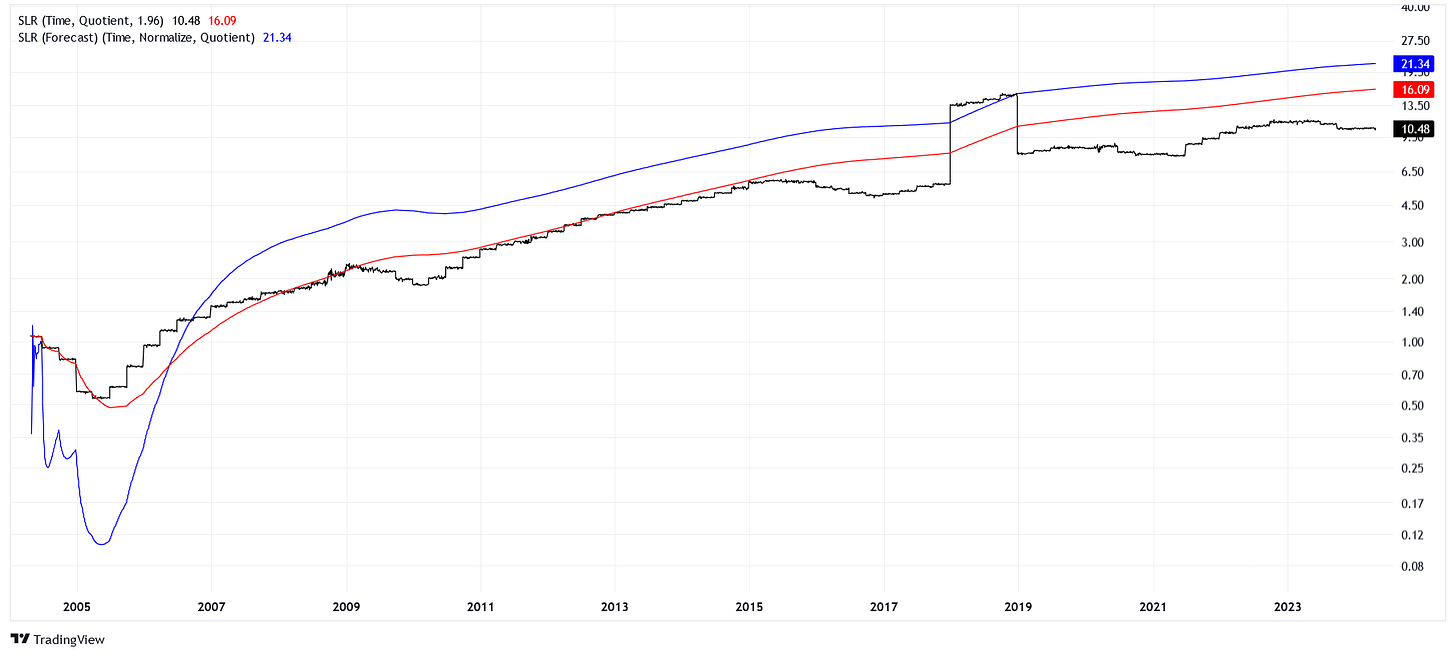

A simple linear regression attempts to explain one variable by using a different variable. For instance, we could try to explain the earnings per share (EPS) history of a company using only time. The reasoning is simple; in plain English, we say that, generally, '“a company grows its income over time.”

When we fit a regression model on some explanatory variable, time in our case, we can simply feed the same input values back into the model to arrive at a “line of best fit.” The power of modeling comes when we use new inputs. From new inputs, the model creates predictions. In our example, we are going to take the year variable and add two years to it. We are trying to predict what the EPS will be two years from now, using the known trend.

The chart above shows the EPS history of UNP. The red line is a model that is predicting EPS using the same time input that was used to train it. The blue line is predicting EPS using a time input that has been shifted up by two years. Notice that the “younger” the model is, the worse predictions it makes for the future. This is the main downfall of linear regression models, they have little predictive power outside of the range of original inputs.

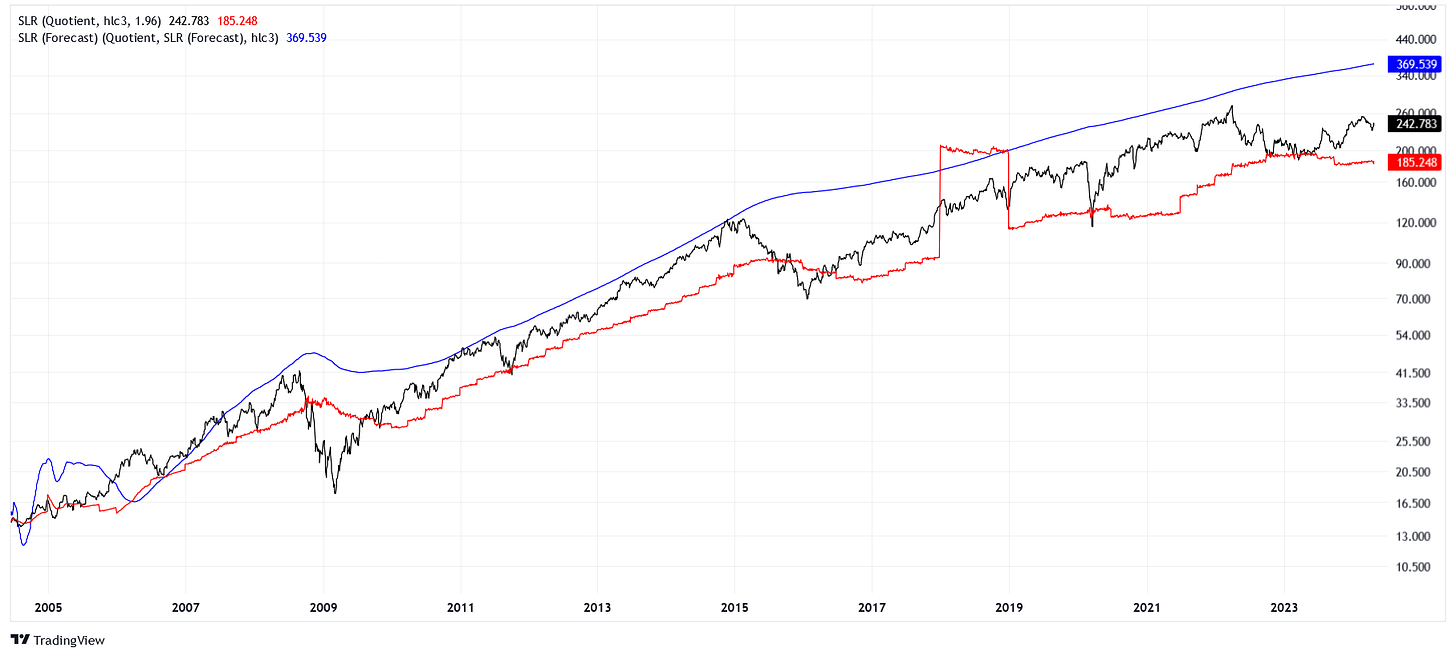

Now, we have to take this one step further. Let’s say we want to predict price per share (PPS) by EPS. This is not unreasonable. For every dollar I invest into a company, I want them to pay me something back. Generally, this is expressed as a price to earnings ratio. We will predict price using both the actual EPS, but also by the EPS we expect in the future (refer to the blue line above)

Notice that the actual price tends to follow the red line, which predicts price using the current EPS. However, there are deviations where the price more closely resembles the blue line. What does this mean? There are times at which the market is willing to pay for earnings it expects to receive in the future. Essentially, the market is getting ahead of itself, trying to front-run earnings projections. This is actually quite rational if the majority of market participants believe it to be rational.

The trick is that the appetite of the market is constantly shifting. Time preference is always moving back and forth. Sometimes it’s optimistic and it moves into the future. Sometimes it’s pessimistic and shifts into the past. What does that tell us? The market wants to pay for EPS it can be “sure of,” or what is in essence an EPS surplus in the company’s history.

What if we were able to solve for the change in time preference?

A Clear Result

We’re in luck; we can do that! How it’s done... well, that may be a little too technical.

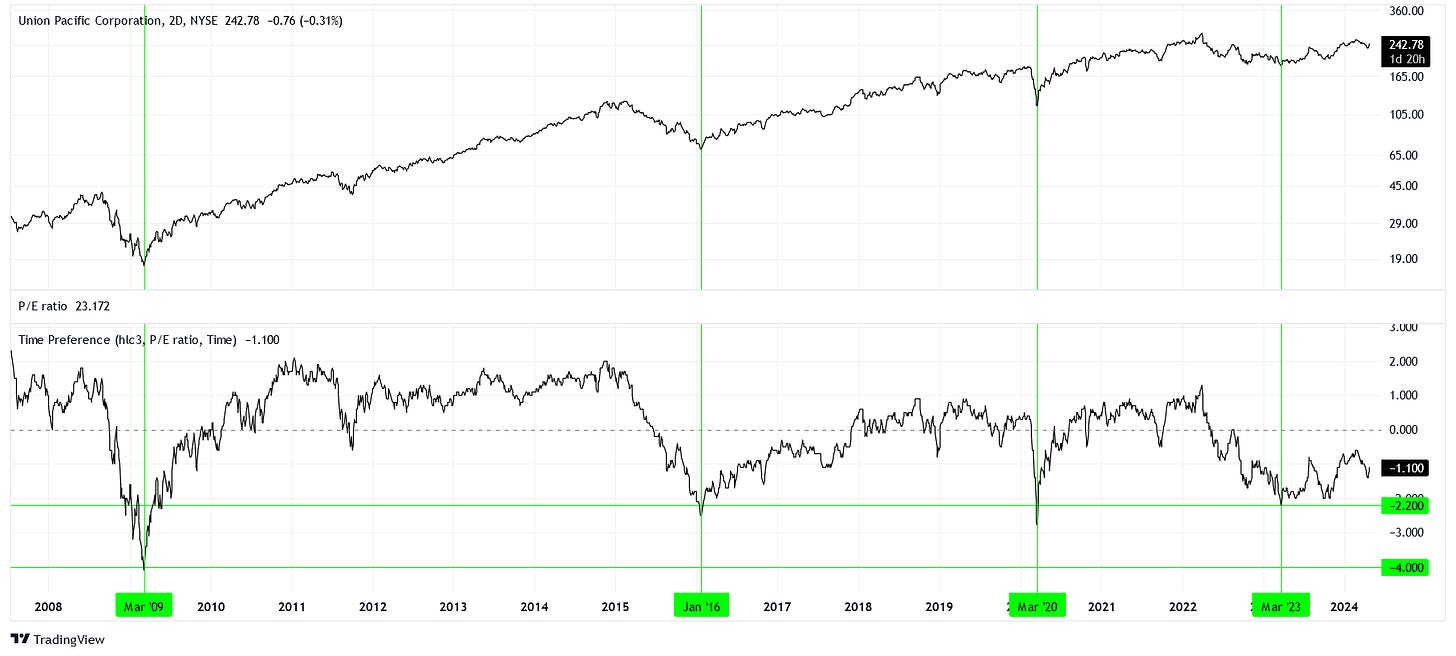

Words cannot express how powerful of an idea I believe this to be. What we’re looking at on the bottom of the chart above is a delta valued in years. Essentially, we have converted the dollar price of a stock into the price in years. Negative values mean a discount in time, positive values a premium. Investors hear that the market is a discounting mechanism, but they rarely get to see what that means literally.

Let’s take March 2009 as a case study. The time preference for UNP was as low as -4. What does this mean? At the time, the market was willing to pay for UNP what it could have expected from the relationship between income and price four years prior. In other words, a four-year discount on the expected EPS.

Why so cheap? When the market gets pushed to the margin and there is forced selling, it becomes irrational, and some people have to sell at any price, no matter how low. It’s the opposite of a bubble where marginal buyers feel they have to buy, no matter how high.

We can see three other times where there was at least a discount of -2.2 years. These are January 2016, March 2020, and March 2023. Notice that all of these points would make for excellent entries.

There’s much more that I could say about the model, but this article is feeling a little long in the tooth. Perhaps after further exploration, I’ll make another post about this topic.