Calling the Top (pt. 3)

It's a "top," not a top.

In this week’s article, we clarify what is meant by a “top.”

What Is a “Top?”

Don’t think that you know more than the market; no one does.

– John C. Bogle

As wonderful as it would be to buy absolute bottoms and sell absolute tops, it is simply not possible.

The funny thing about trading assets is that although we operate on levels (prices), most assets are better analyzed using trends (prices grow over time). Because of this, technical analysis is best suited to indicate deviations in trends rather than levels.

A good analogy is a car driving down the road.

The control a driver has over the car’s position (akin to prices) is the gas pedal. When you press down on the pedal, the car accelerates, which increases its speed (akin to price trends) at a linear rate if acceleration is held constant. Since speed is increasing linearly, position is increasing even faster. This means that position responds quadratically to acceleration while speed responds linearly.

This is a bit different than asset pricing, where a price level responds geometrically to a growth rate (like acceleration).

When we notice a pivot in market trend, we know that the direction in price will likely change - but we don’t know at what price that will happen. This might seem like a cop-out, but we cannot let the perfect be the enemy of the good.

We must accept that we can only know so much about how market prices respond to changes in trend.

Smooth Rides, Bumpy Rides

Rather than trying to time perfect trades, we can instead think of “bottoms” and “tops” as demarcations between “smooth rides” and “bumpy rides.”

After a bottom, we can reasonably expect that there will be more reward and less risk. After a top, we can reasonably expect that there will be less reward and more risk.

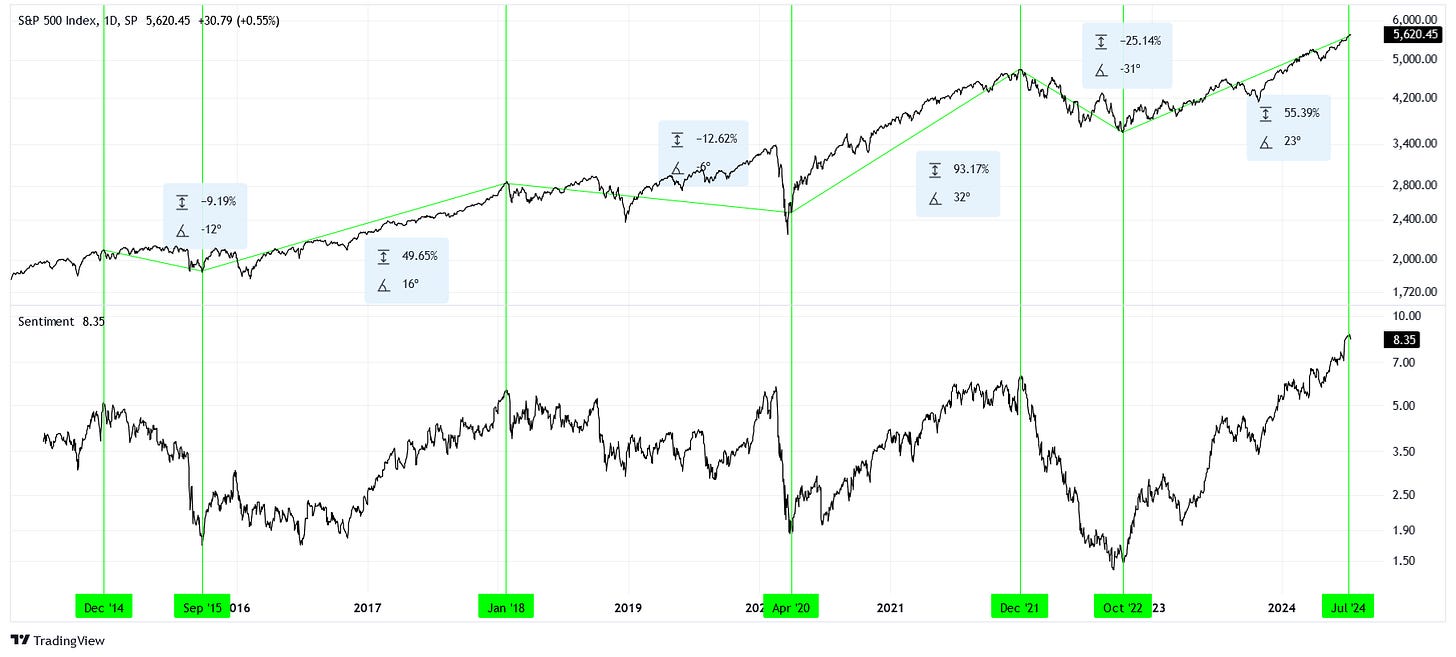

We can once again look at our view of the market and sentiment to make this clear.

TradingView offers an “angle” metric on its “Info Line” drawing tool, which unfortunately has meaningless units (the angle changes depending on the view of the chart) but comparable units nonetheless.

As we can see, if we try to make trades based on sentiment (cherry picked, although imperfectly so), positive angles correspond to trends from bottoms and negative angles correspond to trends from tops.

These are the “smooth rides” and “bumpy rides” we were looking for!

Notice also that deviations from trend are more likely after sentiment has topped out, meaning that “bumpy rides” not only offer flat to negative returns, but they offer more risk and volatility.

Conclusions

That’s about all we can say about what “calling the top” means. I cannot guarantee that price will not push higher, just that to the best of my ability it looks like the best juice has been squeezed since October 2022.

What is to be done? Should you sell all your stocks? Probably not.

But be cautious! I would not be pumped up about buying large-cap American equities right now.