Cash in Hand

Currency in circulation.

In this week’s article, we adjust the market to a subset of the monetary base.

Get Cracking

We’ll keep it brief today.

The monetary base (M0) is the total amount of money in the economy that is directly created and controlled by the central bank. It consists of two components: bank reserves and currency in circulation.

While the decline of physical coins and bills has been evident, you might be surprised to learn that there is still $2.35 trillion floating around in the economy! This series also serves as an interesting basis for normalizing the growth of the stock market.

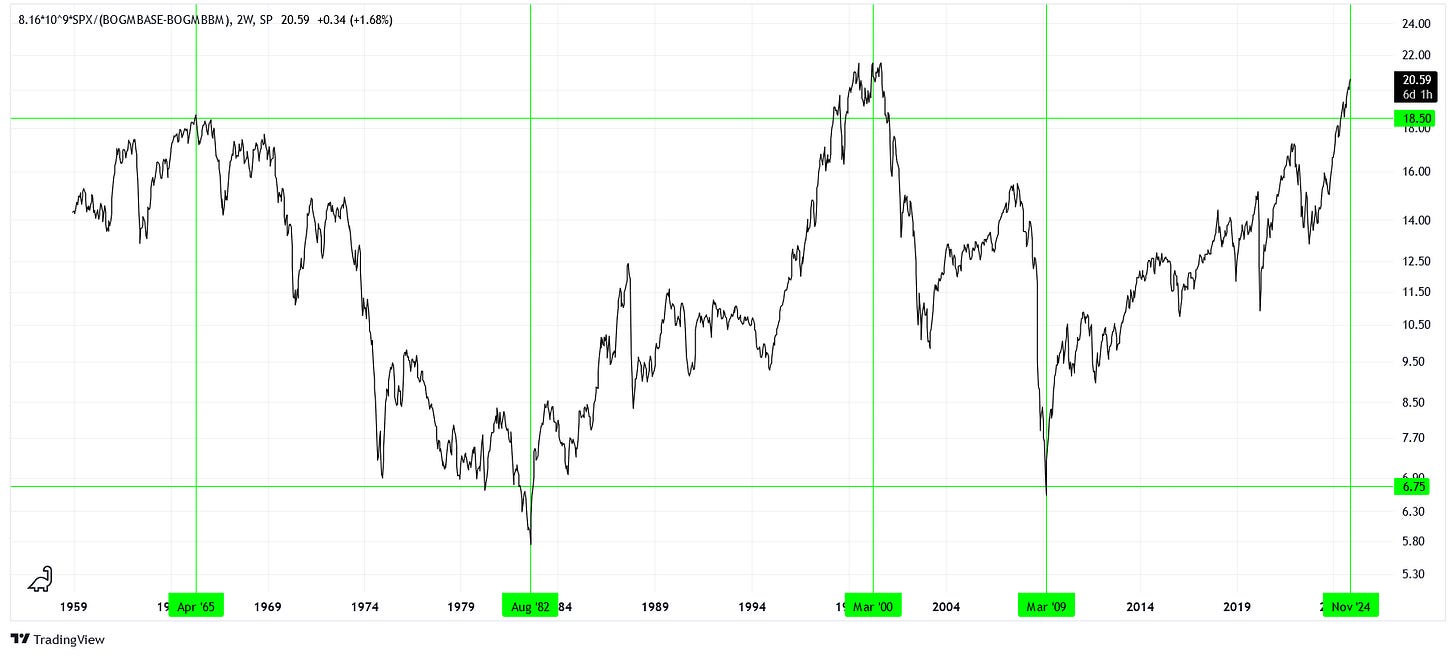

Below is the S&P 500, adjusted by a scaling factor to approximate the size of the equity market, and expressed as a ratio to currency in circulation.

This is one of the most consistent ranges I have observed when normalizing the SPX. Deeply depressed market periods, such as those in 1982 and 2009, appear under a ratio of 6.75x, while extremely overvalued periods, like those in 1965, 2000, and 2024, occur above a ratio of 18.5x.

It’s probably nothing. 😉