Complacent Investing

Passive investors still need to think.

In this week’s article, we remain engaged in our financial process.

Resolution

A second contained within a minute and a minute within an hour… At this rate, it will be a while until we arrive at a millennium. In the same token, let us not forget at what resolution we wish to invest.

Do you want to stay up on the latest news, the subtlest gyration in price, and every word that comes out of the regulators’ mouths? Then your resolution is one of tactics, speed, and efficiency of decision. Think quick!

Would you rather not have to act every day, every week, every month, or perhaps even every year? Then your resolution is one of strategy, gradation, and resolution of action. Take it easy.

Plurality

Make no mistake, neither of these dispositions should be considered “better” than the other. After all, both cheetahs and sloths manage to feed themselves. Or, if we consider scale instead of speed, a leaf feeds a mouse as well as a bale feeds an elephant.

It would be a mistake, however, to confuse ease with passivity and speed with activity.

I’m sure you know of someone who, despite the sound and fury of their tempestuous movements, gets nothing done. Conversely, consider someone who does exactly as they plan to do and nothing more. We can remain active and engaged whether we resolve to trade on a small timeframe or invest on a larger one.

Indifference

When I degrade passivity, I don’t mean that we should not let the investment ride, or fail to relinquish some control over the outcome of our process. When we let the market do its thing instead of fighting it at every turn, good things come. But we should know what we’re getting into.

It sounds fancy to say that you invest in a “diversified, broad-market equity index,” but let’s not kid ourselves. You’re likely buying the Vanguard S&P 500 ETF (VOO) or a similar product. The VOO is not some magical fund, we can dissect it!

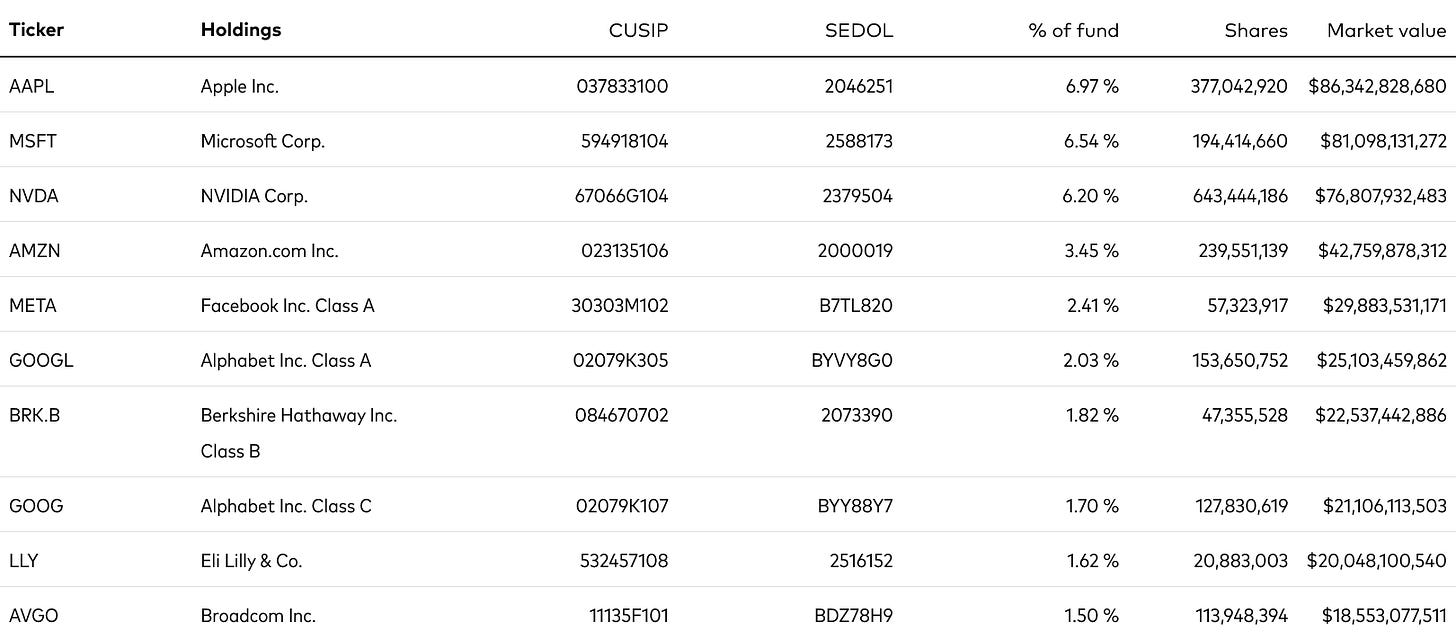

Here are the top 10 largest components of the VOO:

The VOO is not voodoo.

When you invest in an ETF, you own shares of actual companies, and you pay a fee to Vanguard for the convenience. These companies have earnings, or lack thereof, and their stocks have prices. Just because you don’t want to think about these details doesn’t mean your money isn’t tied to their success.

For example, if you were to invest only in the VOO, then almost 20% of the money you put into it goes to three companies: Apple, Microsoft, and NVIDIA. A measly 0.6% of the companies in the index hold 20% of the capital.

So much for diversity!

Engagement

My intent is not to denigrate VOO owners, it’s a perfectly fine ETF with low fees. My intent is to ensure that you know what you own. Simply put, most passive investors don’t know what they own, and I do think that’s a problem.

Your money is a symbolic representation of your labor. Don’t ever let your hard work go into an investment that you don’t understand simply because “everyone else is doing it” or because “finance is too complicated.”

Put in a little bit of effort, just a touch of hard work, and I’m positive that you can formulate your own opinion on where your money is best invested.

A suit from a tailor fits better than one from a warehouse.