Crash Landing

We need to talk about Spirit Airlines.

In this week’s article, we examine a cigar butt (troubled asset).

Pull Up! Pull Up!

If we take the 40,000 foot view of Spirit Airlines (SAVE), the picture ain’t pretty.

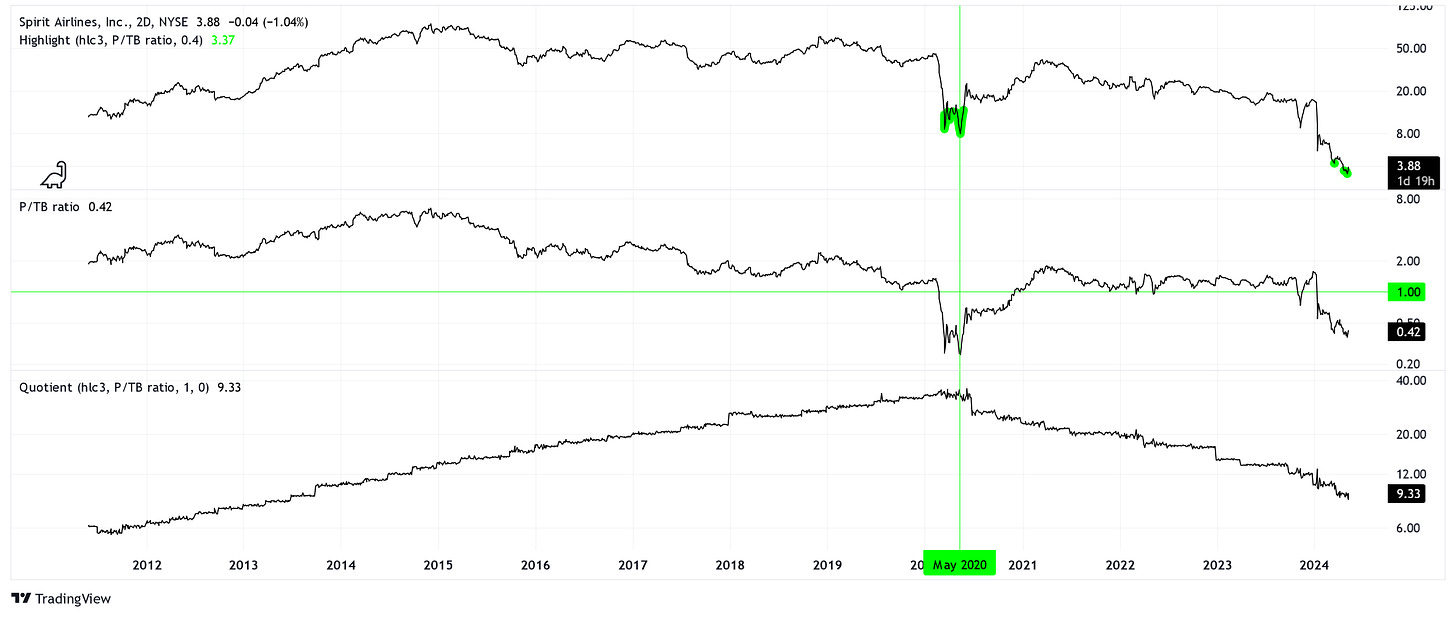

From the all-time high to the cycle low, there has been a -96% decrease in price.

You’re probably thinking there’s something wrong with the company, and you’d be right. Should I start with the -9.2% earnings margins? Or how about the -14.8% free cash flow margins? Oh wait, I know! The 7.1 debt to equity ratio.

So why the heck are we looking at this stock?

Salvage

If a company can’t pay you, or you’re just buying into a bunch of debt, then what else is there to consider? We must check the balance sheet for the answer.

SAVE has about $9.5 billion in total assets. Let’s take this number and subtract the $8.5 billion in total liabilities. That leaves us with $1 billion in what we call “book value.” Care should be taken to also subtract net intangible assets if we want to be conservative, but luckily SAVE doesn’t claim to have any intangible assets.

Compare the $1 billion in tangible book value with the current market capitalization of roughly $460 million. Voila! We have a price to tangible book (P/TB) ratio of 0.46. This means for every 46 cents we throw at the stock, we receive a dollar in tangible assets.

Can it really be that simple?

Careful Now

While a price to tangible book ratio under one is a wonderful thing to consider when purchasing a stock, we should tread lightly.

For one, the book value itself can be eroded over time. This seems to be the case if we examine tangible book value per share, which we derive from the spread between price and the P/TB ratio.

From 2020 to 2024, the book shrunk. Here’s the rub: price shrunk faster!

If we look at the P/TB ratio, we can see that only rarely it dips below one. On the top chart, I highlighted the periods where this ratio was below 0.4. Our current moment is not far from one of these periods!

Now, this is idealistic, but SAVE had a face-ripping rally of +388% from May 2020 to March 2021. You’d have to be quite lucky and brave to realize that kind of profit.

Let’s assume the minimum and consider that their assets should be priced properly. That would be +117%. Not bad at all.

Conclusions

As always, you must do what’s best for you when it comes to investing.

What I like about SAVE is that we can consider value outside of an income stream, and even beyond a load of debt, but there’s a lot more risk in putting money into an company like SAVE.

For the same reason, the reward is sweeter when it works out.