December 2024

The home stretch.

In this month’s review, we keep it simple.

November in Review

Without further ado, let’s see how markets changed in November.

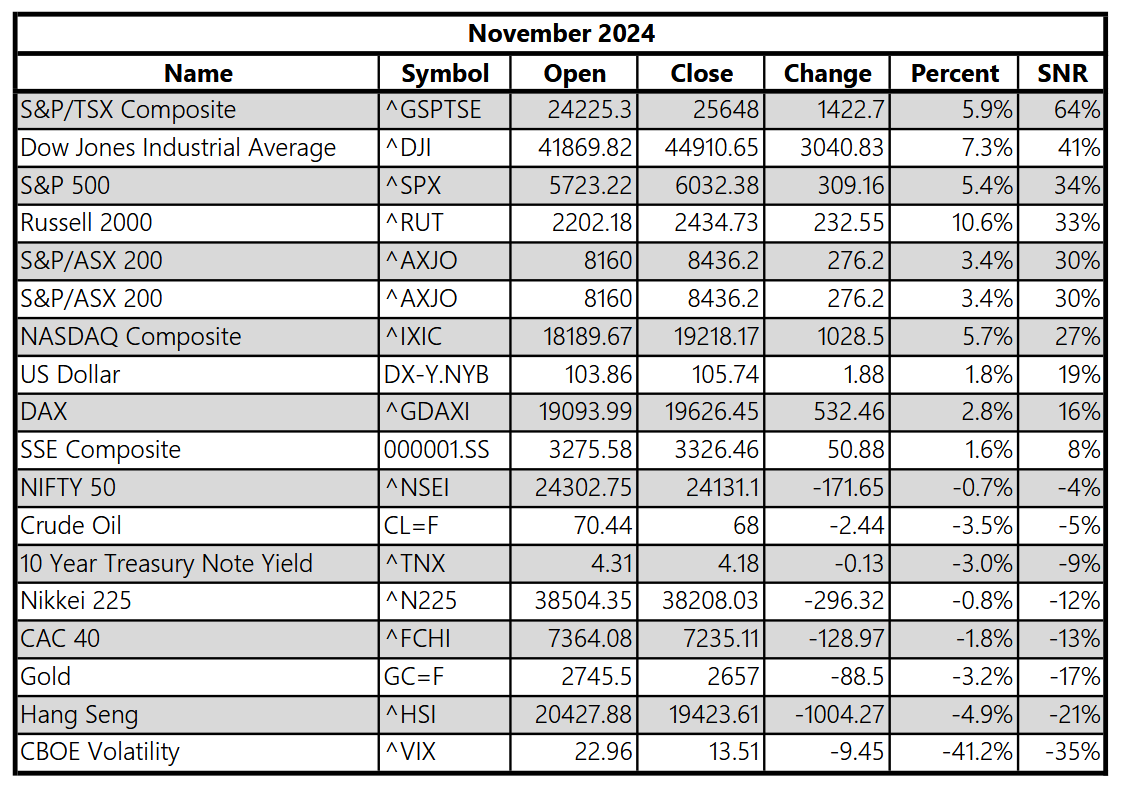

The most notable positive movements were seen in the Canadian, Australian, and United States stock markets. For the U.S. markets, much of the bullish sentiment is attributed to “red sweep” of the election results favoring Donald Trump, who is perceived as a pro-business candidate.

On the other hand, the most significant negative movements occurred in the VIX, Hang Seng index, and gold. Volatility decreased following the election, while gold remained subdued due to reduced safe-haven demand.

This suggests evidence of a re-ignition in equity markets and a reduced likelihood of a severe recession. However, we know that such optimism rarely persists for long.

I remain skeptical, particularly about the current data on market positioning. It is important to remember that markets are historically expensive. Furthermore, the unresolved issues with corporate debt are likely to reach a critical point in 2025–2026.