Deep Value in Big China

招财进宝

In this week’s article, 我们唤起我们内心的塞思·克拉曼精神.

Zhaocaijinbao

Riches and treasures come into the house.

Liquidation Value

Imagine if you had to sell all of your belongings in a hurry—say, within a week. To offload everything quickly, you’d likely need to sell most items at a steep discount to attract buyers. For items that don’t attract buyers, you’d simply have to discard them.

Under financial stress, a company might face a similar situation. The book value of its assets becomes less relevant, and those valuations must be discounted. However, the company still owes money in the form of liabilities.

All told, we can calculate liquidation value by taking total assets less intangible assets, applying a discount factor, and then subtracting liabilities from the discounted tangible assets. While this is not the complete formula (different asset types require different discount rates), it’s good enough for our purposes.

We can also flip the problem on its head and instead find the discount factor that would allow the discounted tangible assets to cover both liabilities and market capitalization. The larger the discount factor, the higher the margin of safety!

Net Current Asset Value

Another conservative valuation of a company’s balance sheet is net current asset value (NCAV). Simply put, NCAV is calculated by taking current assets and subtracting liabilities. Current assets are the most liquid ones, like cash, short-term investments, inventory, and receivables. By covering liabilities with only the most liquid assets, we get a clear picture of how the company would perform in a liquidation event.

I like to use ratio analysis on NCAV and liquidation value. All we have to do is divide the market cap by these measures, and if the ratio is under one, we’re looking good.

Dogpile

Enough math—let’s look at some companies!

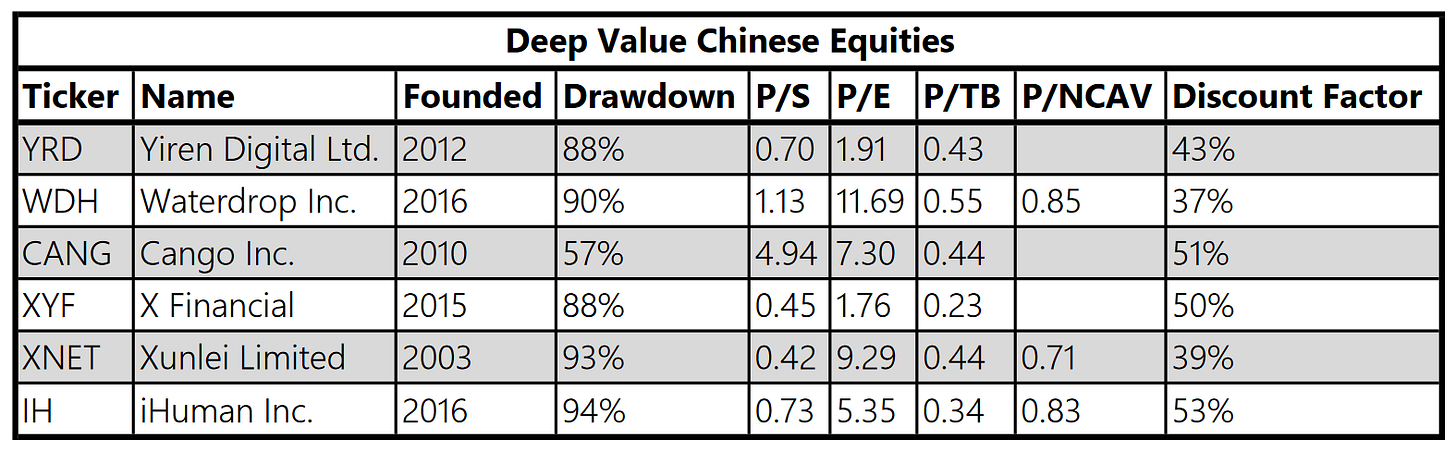

Looking at the table above, we can see that most of these companies have experienced large drawdowns from their respective all-time high (ATH) prices. These drawdowns are mostly around 90% below ATH, with the exception of CANG, which has recovered from its 88% drawdown at the cycle low. While large drawdowns scare most investors away, we’re interested in finding these diamonds in the rough.

Turning to a couple of ratios from these companies’ income statements, we can see that all these companies are profitable, and most have substantial revenue bases. The sales multiples are all near or below one, with the exception of CANG again. A P/S of 4.9 might be common in American markets, but I would be cautious of the high net margins required to turn this revenue into income.

Moving on to earnings multiples, they are all quite reasonable. Every one of them is below 12, a rare valuation in American markets. Some companies, like XYF, have incredibly low P/E ratios. To understand how low a P/E of 1.76 is, we might calculate the earnings yield by taking its inverse, or 85%. It’s unlikely this income is sustainable, but it essentially means that net income could cover 85% of the market capitalization in a single year.

We’re not done yet—we haven’t even looked at the balance sheet, which is the focus of the value metrics defined above! Not only do most of these companies have a tangible book value large enough to cover twice the market capitalization, but the NCAV for the companies we have data on can also cover the market capitalization.

Drilling down into the magnitude of the margin of safety these book values offer, we can look at the discount factor. These range from 37% to 53%, meaning that these companies could discount their tangible assets by those degrees and still cover both liabilities and market capitalization.

Risks

Briefly, let’s touch on some risks inherent in these investments.

If we were Chinese nationals, there wouldn’t be much risk of losing our positions to politics, but as an American myself, the risk is higher that foreign investors could be left holding the bag. It’s unlikely but not impossible.

Furthermore, we have to trust that these companies are reporting accurate numbers in their financial reports. Read through their websites, listen to earnings calls, and analyze financial reports for any discrepancies to discern whether these companies are the “real deal.” A company like Xunlei is established, culturally relevant, and likely trustworthy, but we must do our due diligence for each of these companies.

China itself has experienced a profound deflationary recession that is scaring away a lot of foreign investment, but if we’re brave enough to take a contrarian stance in the face of these risks, the rewards could be significant.