Easy Now

The easing cycle begins.

In this week’s article, we review the Fed’s decision on interest rates.

Making the Cut

On Wednesday, the board of the Federal Open Market Committee (FOMC) voted to cut the overnight Federal funds rate by 50 basis points (this is 0.5%, if you didn’t know).

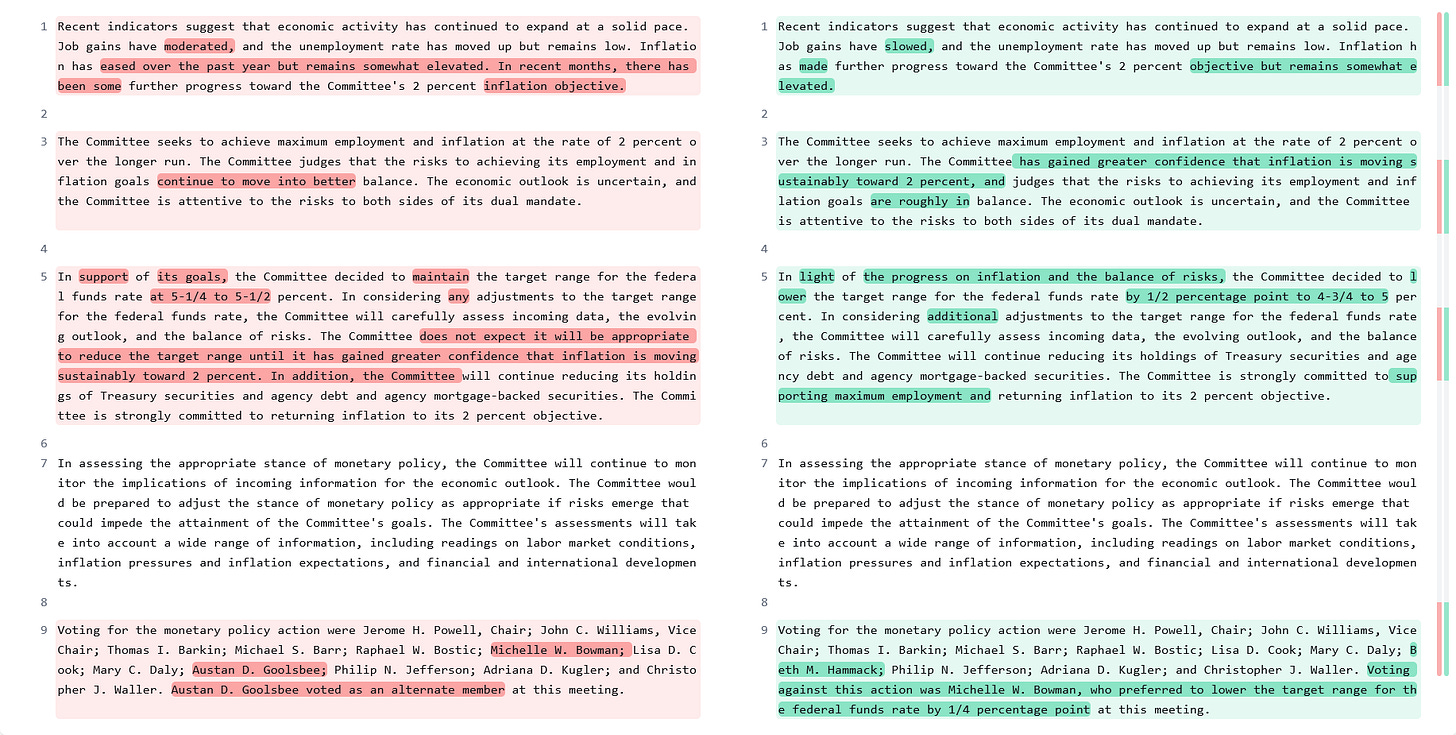

Whenever the FOMC comes out with a new statement, I like to compare it to their previous statement and play a game of “spot the differences.”

From the committee’s perspective, job gains are no longer moderating, they have definitely “slowed.” Furthermore, core inflation remains elevated above the 2% target.

Despite this, the FOMC sees the dual mandate of maximum employment and moderate inflation as “roughly in balance” here. Perhaps I am too bearish, but this sounds to me like the Fed is saying, “this is as good as it’s going to get.”

Notably, Michelle Bowman offered a dissenting vote. She wanted 25 basis points instead of 50. These dissenting votes are quite rare, the past three were during the June 2022, August 2005, and August 2003 meetings.

Why Now?

I mean damn, what would Jeromey Romey Romey Rome think?

— Kanye West, “Bound 2”

During the Q&A section of the FOMC presentation, Jerome Powell offers a slew of data sources: the Personal Consumption Expenditures (PCE) inflation report, the Quarterly Census of Employment and Wages (QCEW) employment report, and the Summary of Commentary on Current Economic Conditions (Beige Book).

If we were truly diligent, we would read all these reports — you probably should. Instead, we’ll cheat and simply look at a chart of the most relevant series!

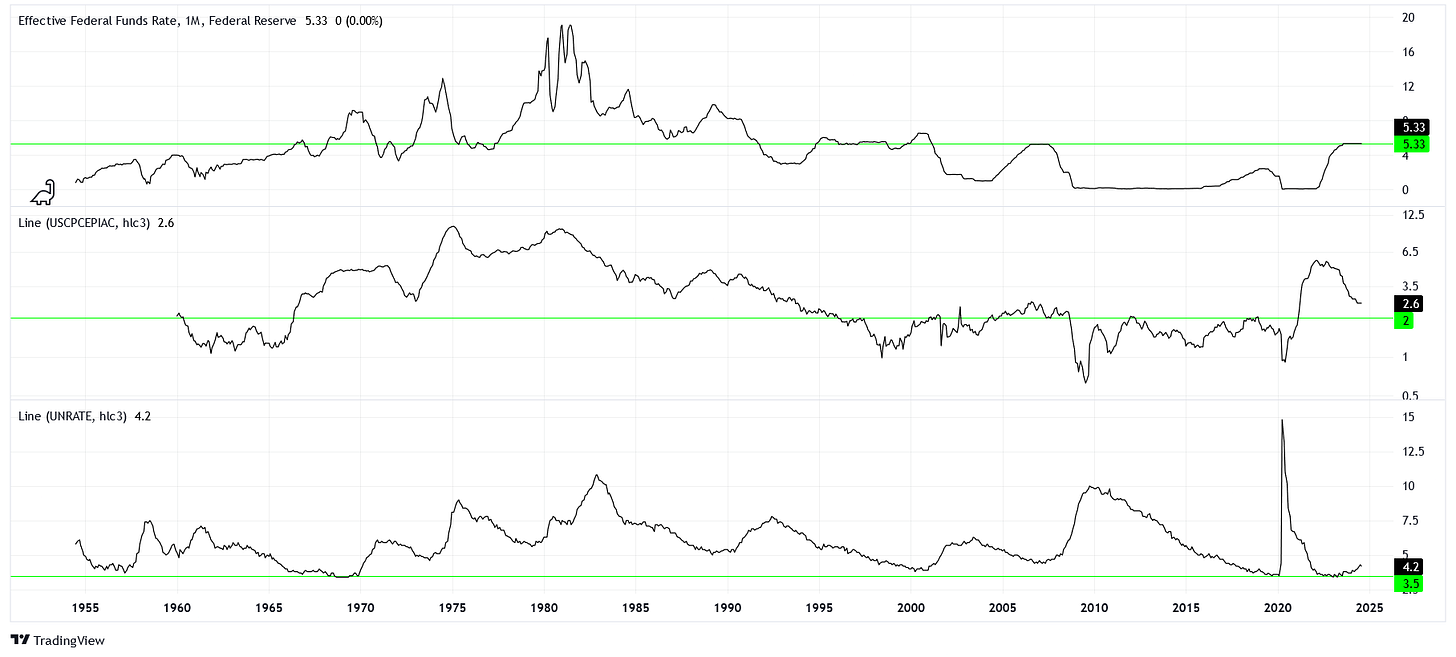

The complete history of these series is included, but look to the past half decade.

During COVID, interest rates were slashed to zero and the economy was stimulated with an unprecedented amount of liquidity. Unemployment shot up as the economy locked down and wages were supplemented. Then, a wave of inflation hit as Americans spent, not saved, their stimulus checks. Finally, the Fed engaged in one of the steepest rate hiking cycles in its history, going from 0% to 5.33% in 18 months. This rate was held constant for 12 months, until it was cut this past week.

Think about it: the Fed started easing. This means that less pressure is being put on inflation going forward, despite the rate of inflation at 2.6% being above the target of 2%. Why risk inflation picking up again?

It must be the labor market. Unemployment is still fairly low at 4.2%, but this is well above the local bottom of 3.5%. It’s enough of a move to trigger the Sahm rule, which typically coincides with where the National Bureau of Economic Research (NBER) eventually labels the start of a recession.

Landing

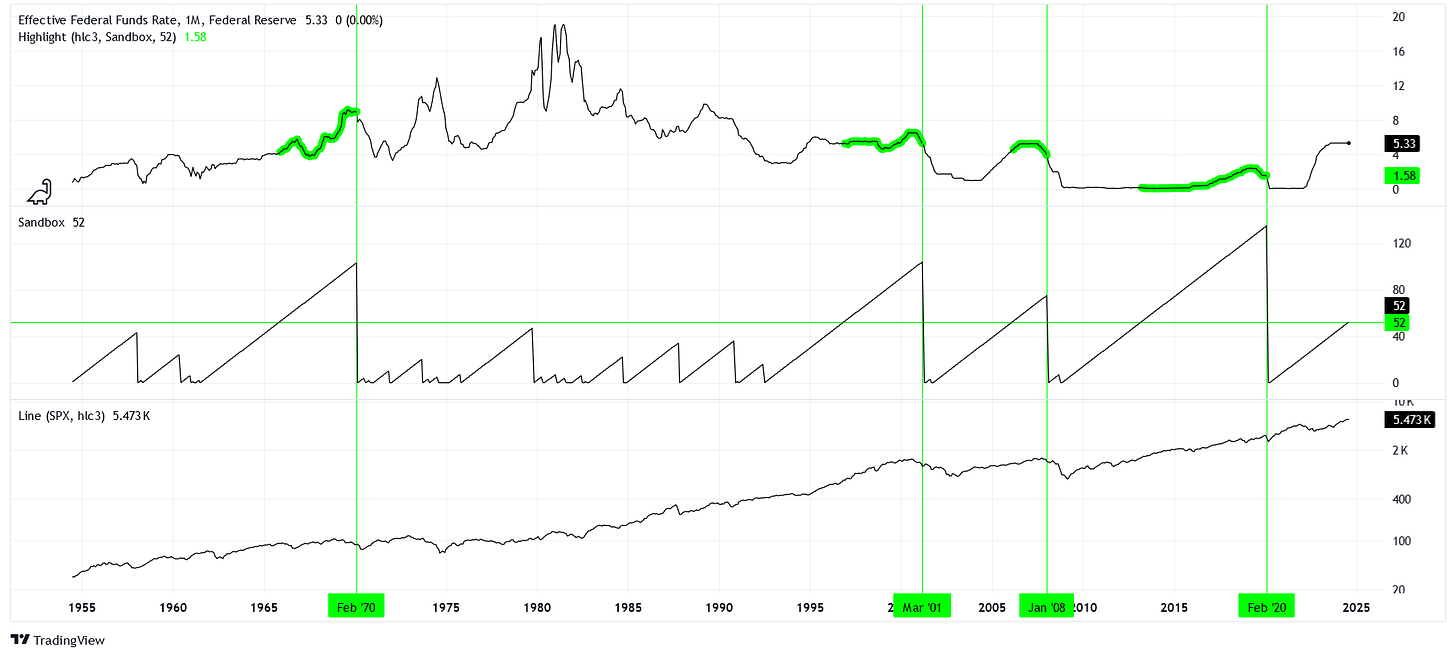

It’s been 52 months since the funds rate has been cut by 0.5% or more. When else has that condition been satisfied? February 2020, January 2008, and March 2001.

I’ll let you make of that what you will.