Insiders Jumping Ship

Selling into strength.

In this week's issue, we examine net insider flows for the Magnificent Seven.

Magnificent Seven

The so-called Magnificent Seven (Mag 7) stocks have garnered significant attention in financial media over the past year. These stocks, listed by size, include Microsoft (MSFT), Apple (AAPL), Alphabet (GOOGL), Amazon (AMZN), NVIDIA (NVDA), and Tesla (TSLA), collectively approaching a total capitalization of $13 trillion. These seven are among the top ten largest stocks, accounting for 29% of the S&P 500's total capitalization. Notably, during the Dotcom bubble, the ten largest stocks represented a concentration of 33%, an analog worth considering.

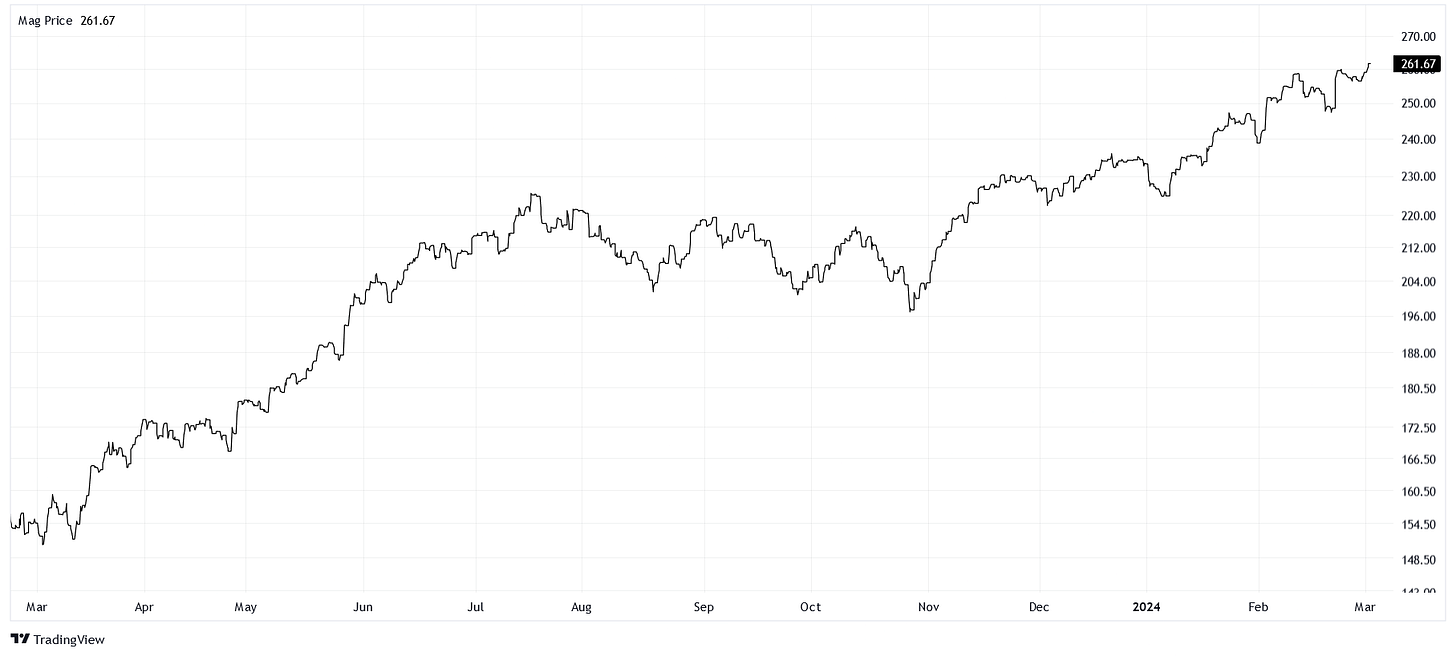

A price index for the Mag 7 reveals impressive performance over the past year.

You may be asking, “where exactly is the problem?”

Net Insider Flows

Utilizing data from EDGAR, we can scrape Form 4 filings for the Mag 7 to monitor insider activity. Generally, stocks tend to exhibit a negative bias over time, indicating that insiders withdraw more from the stock than they invest. However, we can discern trend shifts by accounting for this bias. When we examine insider activity within the Mag 7 over the past year, a simple look at the data will suffice.

Between March 2023 and the end of January 2024, slightly slightly more than a billion dollars was withdrawn from these stocks. February marked a notable acceleration in the rate of selling, with over $9 billion in sales recorded in the past month alone. Clearly, insiders are thinking this is a good time to take profits.

Conclusions

The Mag 7 are called the “generals” due to their historical tendency to lead the market into bear and bull phases in recent years. When the insiders of these companies collectively sell in bulk, showing little confidence for the future performance of their stocks at this valuation, shouldn't we consider taking some risk off of the table as well?