July 2024

Ave, Caesar!

In this month’s review, we check in on our common assets and expand the stock-picking universe.

June in Review

Without any fanfare, let’s dig into how the assets in our watchlist did.

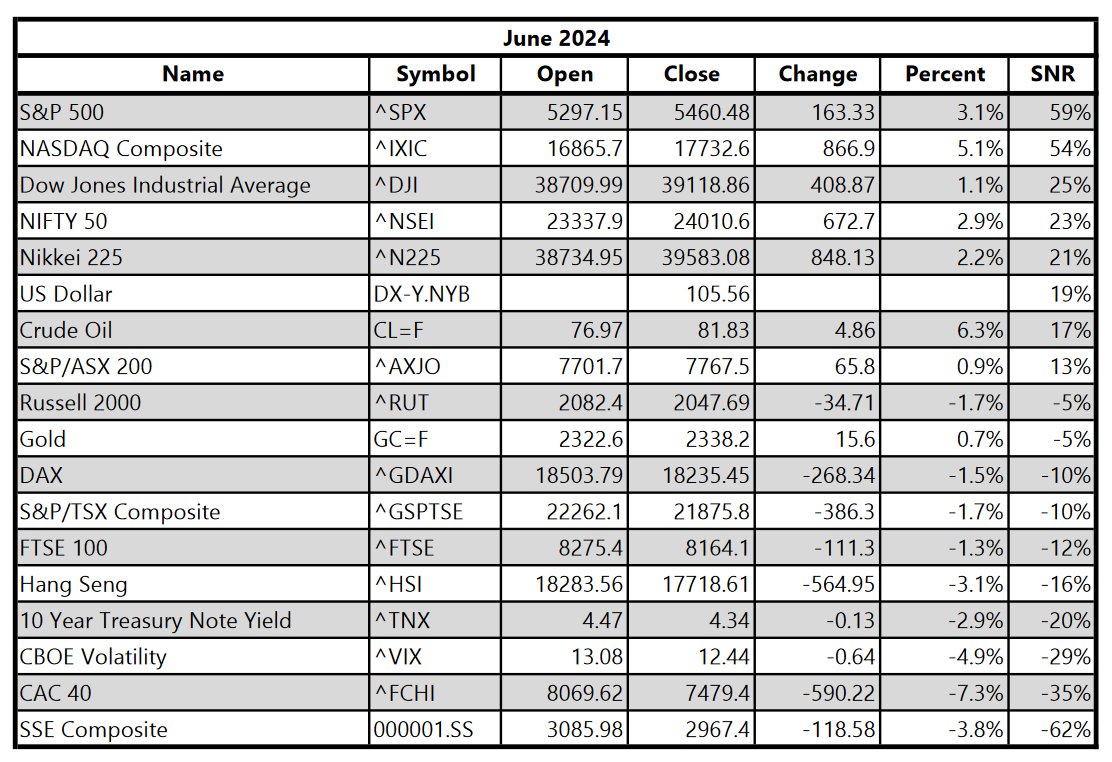

American equity indexes came in strong once again, with the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average composing the top three assets according to their signal-to-noise ratios (SNRs). Notably, the percentage change of these assets were more muted than in May.

Conversely, equity indexes in China (SSE Composite) and France (CAC 40) did poorly. Option volatility (VIX) continued its multi-month decline by losing a further -0.64 points for the month. The 10-year Treasury decreased by -0.13 points.

Gold remained flat. For some reason, the U.S. dollar index bugged this month, I’ll look into that for next time.

High Flyers

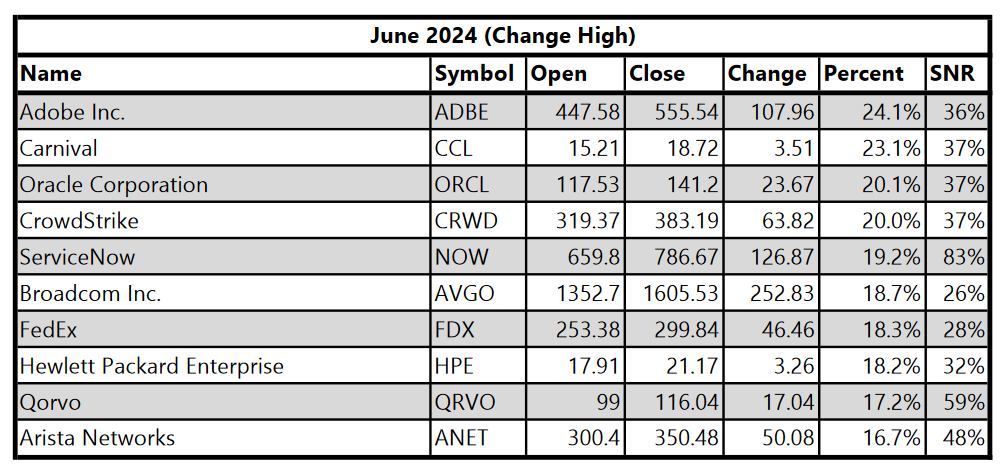

For July, we have expanded our automated scraping process to the S&P 500 instead of the Nasdaq-100. Out of these supposed 500 companies (actually 503 currently), here are the best performers for June 2024, ranked by their SNR.

Eli Lilly (LLY) continues to be on an absolute tear. Its share price has tripled since March 2023 and it had a smooth 10% gain this past month. I have to be honest, I’ve doubted this stock for a while now, and am envious of the gains. That being said, I am still cautious! With a P/E of 135 and a P/S of a whopping 22.8, this sucker is expensive.

Otherwise, glancing at the charts for the stocks in this list, AVB appears to be on track to its all time highs of $235 from the current $206 level.

While SNR is a personal favorite measure, I realize that percent change is just as powerful of a measure, it really depends on the context. So, let’s look at the best performing stocks for June while we’re at it!

A more mixed bag than the last list, we have big tech alongside beaten up companies. Carnival (CCL) is one that I’ve looked at in the past, and the chart is very bullish here. I don’t think +20% to +50% would be much to ask from CCL given its P/S history.

Stinkers

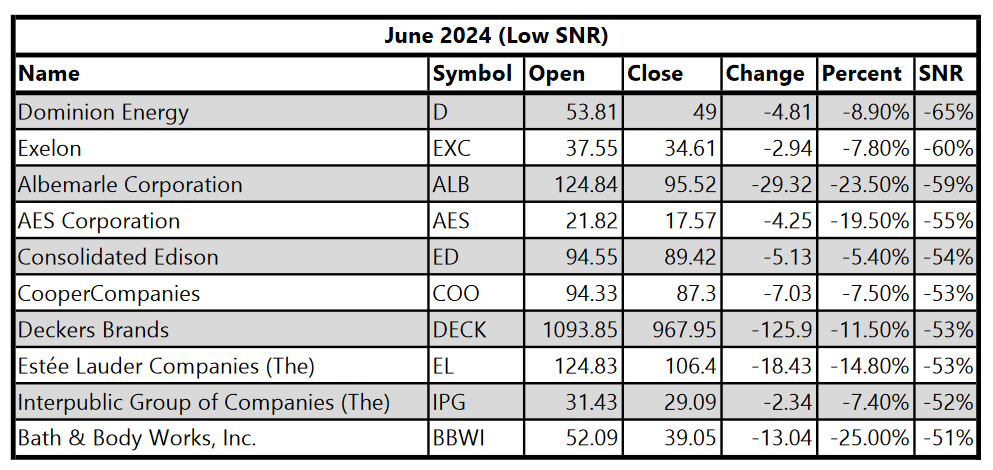

Starting with the lowest SNR stocks for June, we see some utilities and material stocks at the top of the list.

I’ve had my eyes on Dominion Energy (D) for a while, wanting to go long. This might be a decent entry point, I think October 2023 was the low for now.

Albemarle (ALB) might be an interesting lithium play if you are into electric vehicles, they are trying to open lithium operations in the U.S., but I don’t know much about the company’s business beyond that.

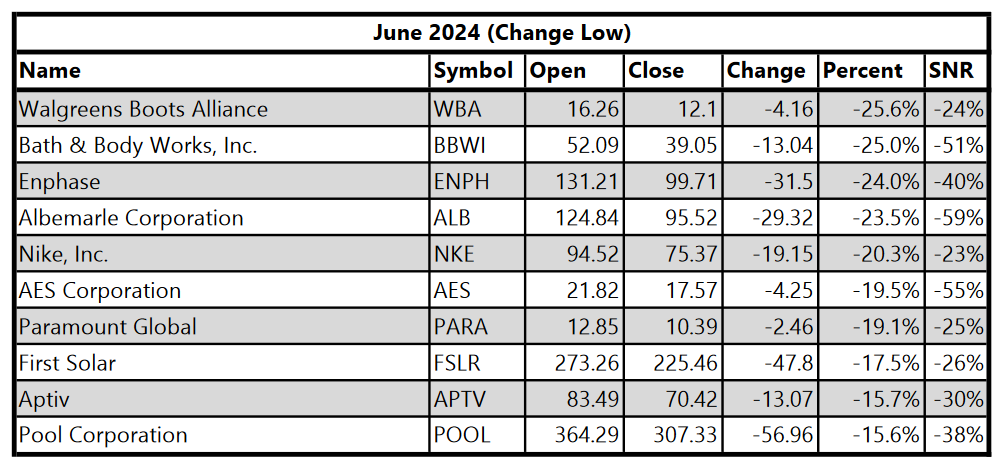

I own a nibble of Walgreens (WBA) already, so June was a very painful month for a very small position. My nibbles are more like bookmarks, they signify something I want to own but am not committed to yet. With this drop, the P/S of WBA is pushed down to shockingly low value of 0.07. With that much revenue power behind the stock, I believe that management can turn around the stock’s nearly 9 year slide.

Nike (NKE) is another favorite for me to watch. I even tuned into their earnings call, which was insufferable because of the “sports slang” they awkwardly threw around. Regardless, I think NKE is getting into decent buy territory. Not bottom of the barrel, mind you, just not the ridiculous valuations it had for the past several years.

Disclaimer

The content provided is for informational and educational purposes. It is not financial advice. You are solely responsible for your investment decisions. The author assumes no liability for losses or damages resulting from decisions based on the content provided.