June 2024

Frothy and quiet.

In this month’s review, we use expand our automated process into equities.

May in Review

As with last month, we can take a look at our “common” assets using an automated process. I’m still perfecting the technique, so there may be some mistakes.

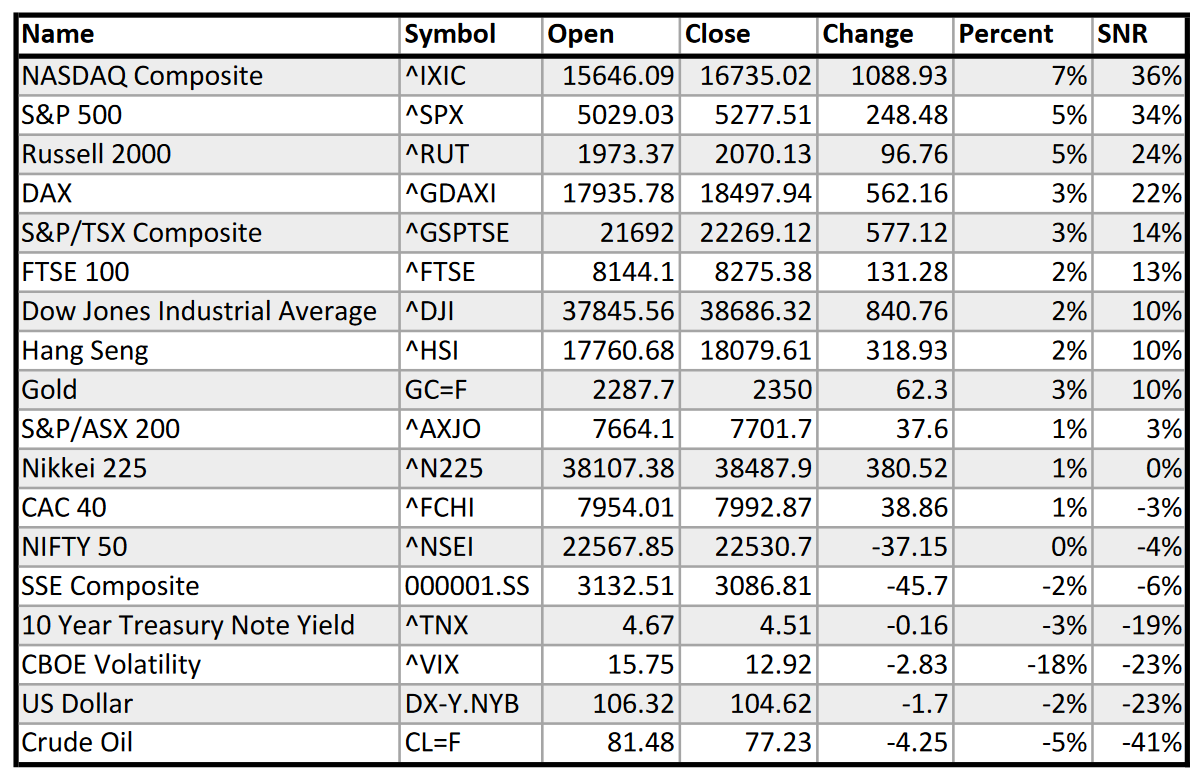

Sorted by their signal-to-noise (SNR) ratio, let’s dig in.

The American equity indexes took the lead with the Nasdaq, S&P 500, and Russell 2000 all up by at least +5%. Around the world, equities generally performed well. Some exceptions might be China’s SSE Composite index coming in at around -2% and the NIFTY 50 of India remaining flat.

Tailwinds that might account for the good performance in equities are falling oil prices (-5%) and a weakening U.S. dollar (-2%). CBOE option volatility (VIX) collapsed by -18%. Even the 10-year Treasury note moved down by -0.16 points.

The Good

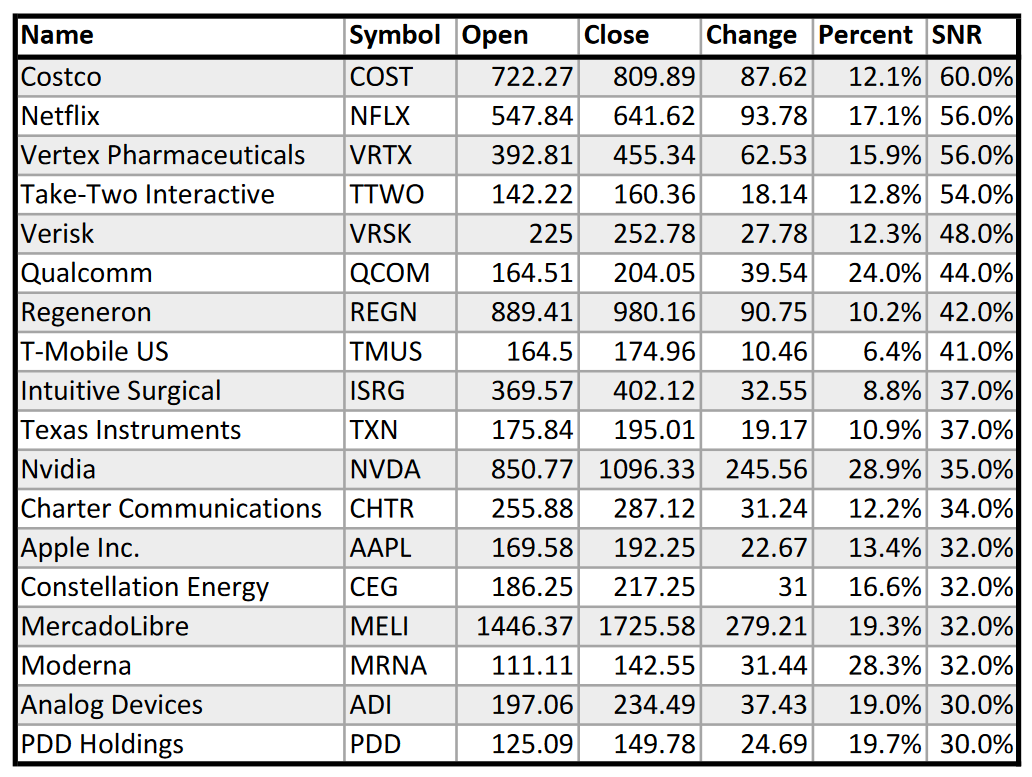

This month, we can expand our automation out to the Nasdaq-100 index components as a start. In the future, we can scrape a larger index to find more opportunities, but for the sake of simplicity we’ll keep the universe small for now.

So, what did well this month?

We should acknowledge the discrepancy between the SNR and the actual percentage change. Notice that stocks like NVIDIA (NVDA) and Moderna (MRNA) are the dominant companies this month based purely on performance. This is important! If you actually traded NVDA from the start to the end of May, you would be up +28.9%, a huge profit. The SNR doesn’t only care about the magnitude of the move, it also factors in how much volatility was experienced.

For example, Costco’s (COST) +12.1% increase is clearly smaller than NVDA’s, but the ride was much smoother. This is also important! We not only want to make a profit, but we want to be comfortable doing so. The tradeoff between performance and volatility is a personal tolerance, there is no “best” option. If you don’t want to risk losing any principal, you can consider bonds. If you don’t want to risk losing additional performance, you can consider equities.

The Bad

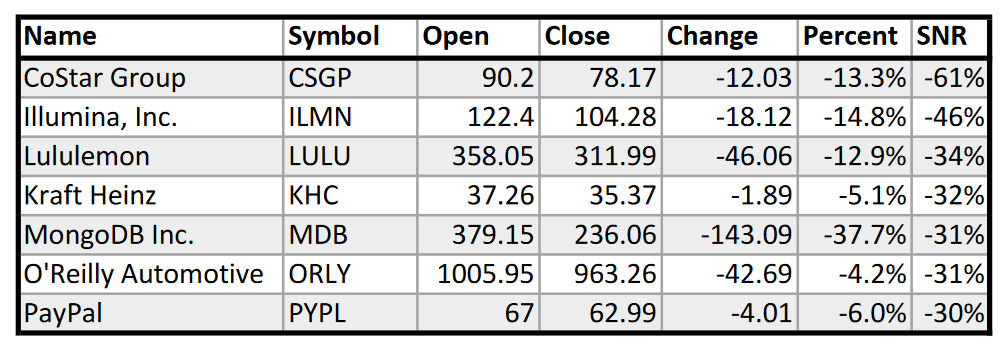

We can also consider the opposite question, what did poorly in May?

In sheer performance numbers, MongoDB (MDB) did the worst at -37.7%. In SNR numbers, CoStar Group (CSGP) did the worst at -0.61 SNR. Reporting the SNR in percentages is not really appropriate, but it’s too late now!

Of these companies, I like PayPal (PYPL) at these levels.

The chart speaks for itself, no analysis needed.

Replay

Last month, we highlighted the Dow Jones Industrial Average near 37,800 points (DJI). In a boomerang fashion, the DJI would gain nearly +5.2% and then lose -4.4%. Currently, it sits not too far above the original highlighted level.

Intel Corporation (INTC) was also highlighted last month around $30.80. Between then and now, it’s been just under $30.00 to a touch over $32.50. Currently, it’s a little under the highlighted level.

Admittedly, I’m not great at short time-frame trades. What to make of these gyrations? I don’t know. The INTC pattern still looks strong to me. Regardless, not much has changed since these calls last month, I still “believe” in them.

Disclaimer

The content provided is for informational and educational purposes. It is not financial advice. You are solely responsible for your investment decisions. The author assumes no liability for losses or damages resulting from decisions based on the content provided.