March 2024

Beware the Ides.

In this month’s update, we consider the current bullish trend, review our stock pick of the month, and consider the road ahead.

February in Review

This month saw a re-acceleration in the current rally. The S&P 500 rose by +5.17%, the Nasdaq Composite by +6.12%, and the Russell 2000 reversed some of January's losses, coming in at +5.52% higher. The Dow Jones Industrial Average was more reserved with a +2.22% gain. Globally, China experienced a huge reversal with the SSE Composite increasing by +8.13%, and the Japanese Nikkei 225 followed up a stellar January with another +7.94% rise. Pay close attention to the U.K.'s FTSE 100 in March, which closed almost exactly flat on the month. It is coiled against ATH and with a P/E of 10.29, P/S of 1.16, and a P/B of 1.67, it has a good comparative valuation. Compare this to the NASDAQ 100, which has a P/E of 35.03, P/S of 4.98, and P/B of 7.95.

The U.S. 10-year government bond rate increased by +0.336% and is now sitting at 4.25%. The Federal Funds rate was held constant for the sixth month in a row. The VIX was squished, declining by -0.95 points.

Commodities (GSCI) increased slightly, up 0.52%. Watch this index; the mainstream narrative is that “inflation is re-accelerating,” but the evidence is weak so far. Gold prices declined by -0.62%, but the “digital gold” Bitcoin exploded higher by +44.06%. It is likely that Bitcoin can recapture its ATH of $69,000 as it reached $64,000 this month.

Equity Flows

Compared to January, we saw a lot more green in the big movers this month.

NVDA remained the most active stock, increasing by +25.77% with flows of $876B. CEG was the big winner, moving up by +38.84% on $7.9B in flows. CHTR took a beating, down by -22.15% with $14.3B in flows.

The behavior of February was decidedly more bullish than January, as many stocks were firmly in the green with a lot of capital behind them.

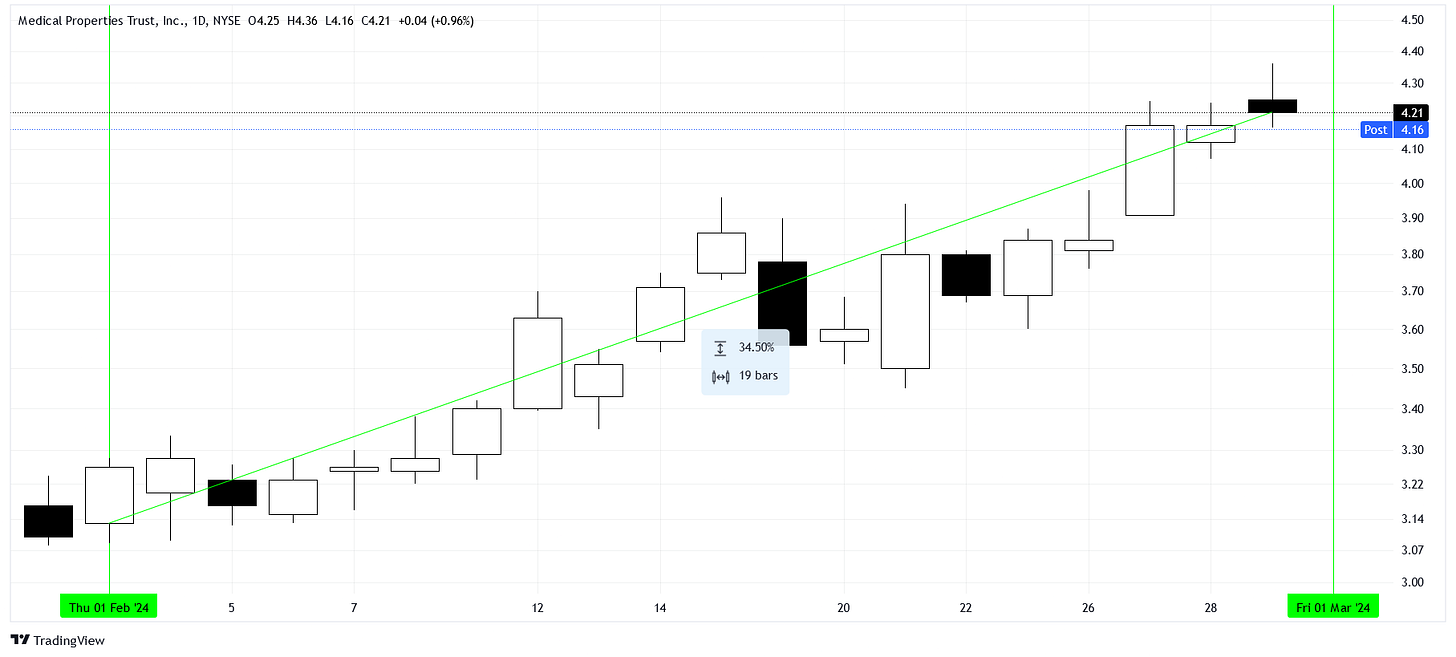

MPW Update

The beat-up REIT we highlighted at the start of February had a phenomenal month, increasing by +34.5%.

This was the most bullish month the REIT has seen since April 2009, likely denoting a major shift in sentiment for the issue. We imagine that as a long-term hold, this name should have little resistance up to about a 50% retracement, or $12.

Pump the Brakes

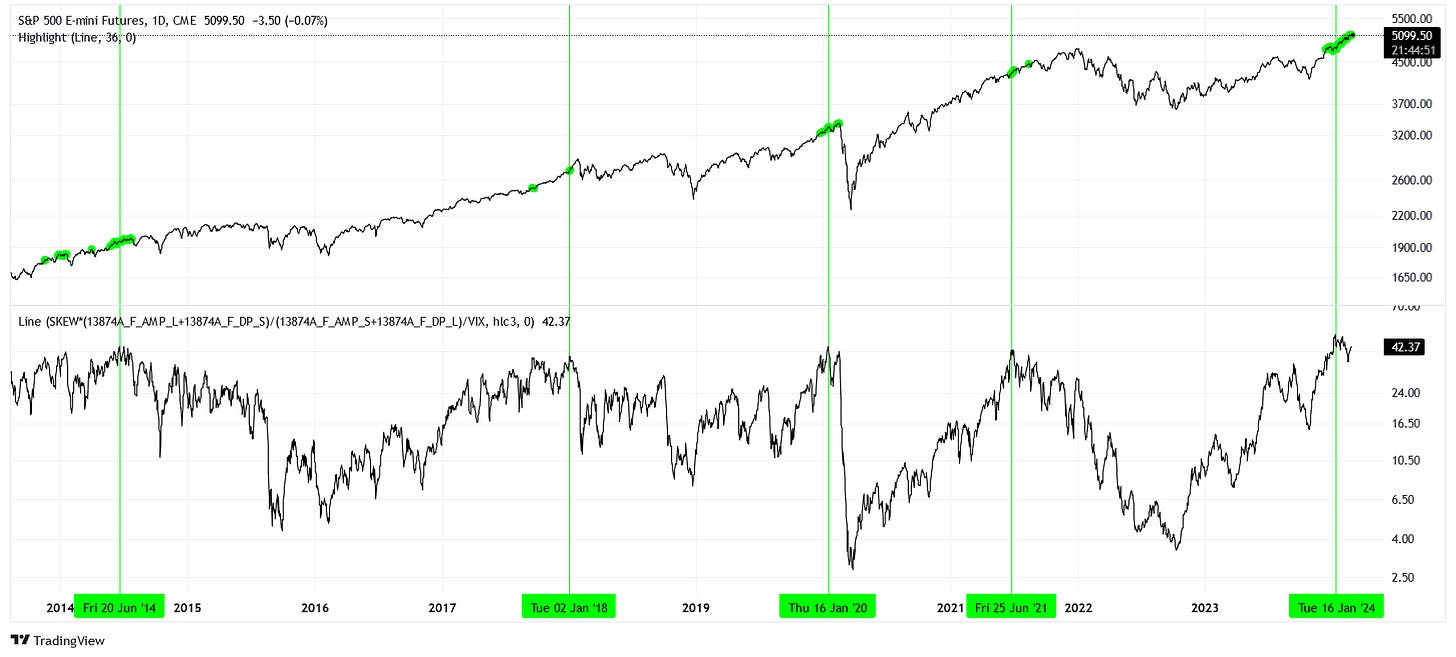

It is painful to have restraint when the market is partying, but it appears to be the right thing to do. If we look at a custom sentiment indicator that incorporates positioning from smart and dumb money, as well as popular options indexes like the VIX and SKEW, we appear to be quite extended.

Our situation resembles that of June 2021, January 2020, January 2018, and June 2014. Each of these periods would eventually give us much better places to add, although one has to have patience waiting for trends on this timescale. It could be a year or two before we can start making big bets like October 2022.

This is not to say there is no alpha to be found within certain assets, sectors, or issues, of course. This is also not to say that you cannot bet on the market in the short-term. It simply means that going long the market for the long-term at these levels carry quite a bit of risk.

Disclaimer

The content provided is for informational and educational purposes. It is not financial advice. You are solely responsible for your investment decisions. The author assumes no liability for losses or damages resulting from decisions based on the content provided.