November 2024

An attitude of gratitude.

In this month’s review, our automated financial review is further jeopardized.

Setbacks

Once again, Yahoo Finance has thrown a wrench into my data-gathering process. Now, not even the workaround I devised last month is working.

I won’t lie, this is getting frustrating.

There’s one last-ditch process that I can think of that would allow me to maintain the automated market reviews. If that fails, I may have to pivot to something else.

October in Review

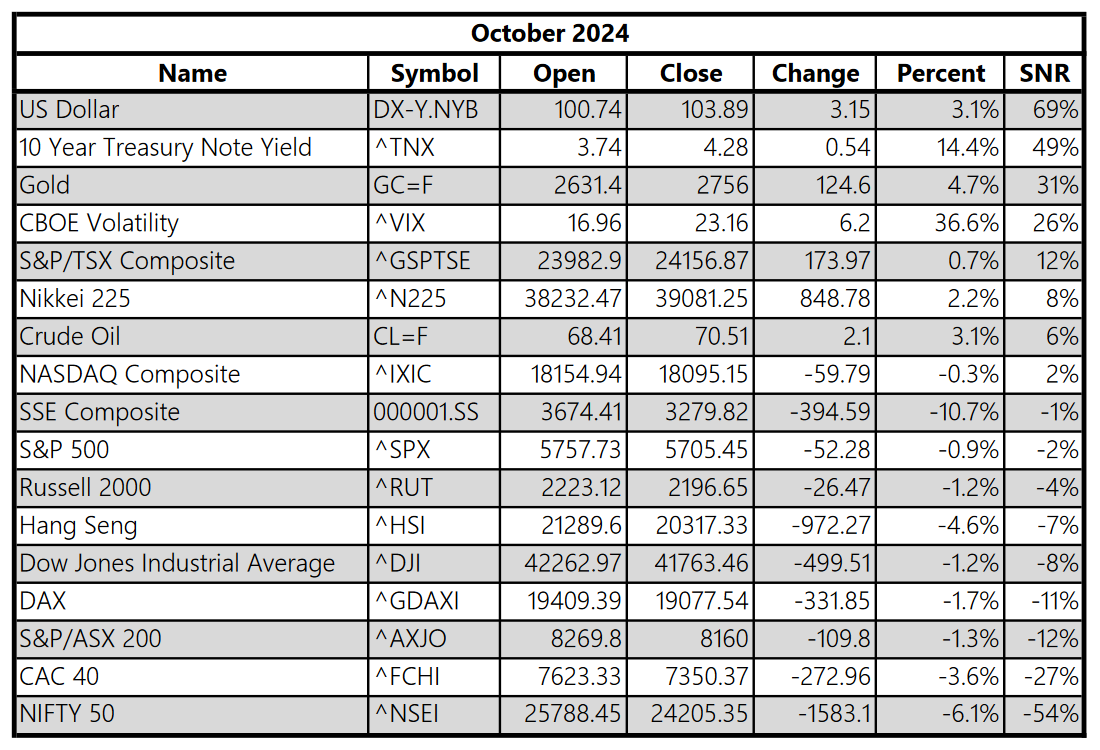

With much exertion, I present October’s digest.

The definitive upward movements this past month were seen in the dollar, 10-year yields, gold, and the VIX. The definitive downward movements were seen in equity markets, notably in India and France. China’s SSE Composite index had a larger magnitude move down, but the move was not as clean as India’s decline.

With the recent gyrations of the U.S. dollar, the 10-year Treasury Note yield, gold, and the VIX, volatility is being introduced into the foundations upon which equity markets depend. There’s a lot of uncertainty in the markets, even if it doesn’t translate directly into the performance of the S&P 500, for instance.

You might find it interesting that 10-year yields are hovering around 4.3% now, and with money market funds paying approximately 4.75%, the spread between the two is narrow. If you invest in fixed income, consider opting for longer-term yields here.