October 2024

Fall arrives.

In this month’s review, we hurdle a blow to our automated reviews, marvel at Chinese indexes, and witness the flight to safety.

Hiccup

I had been using Yahoo Finance’s historical quote data for my analyses until the service was shuffled behind a paywall this past month. Not wanting to pay $480 annually for a data source that I had found for free a couple of years back, I began searching for alternatives.

Nasdaq offers free quotes for the stocks found on their exchange, with a full decade of the daily open, high, low, and close prices being available. This will suffice for the short-term analyses performed in the monthly reviews here, but I was used to data that went back to the mid-1960s.

With Macrotrends, we can scrape entire histories of quote data for the stocks available, but not without a catch. I’ve already found examples of poorly adjusted prices on some stocks (due to splits or spin-offs), so I don’t fully trust this data.

These alternate sources of data are serviceable, but I do miss the free, full, and quality data from Yahoo Finance. Furthermore, these other providers don’t have quotes for indexes and futures like Yahoo does.

If I manage to find a perfect replacement, I’ll let you know. For now, there will be no stock screening section in this month’s review (sorry).

September in Review

Even with the workarounds I found for losing access to Yahoo’s data, we don’t have the FTSE data this month. If updates to the United Kingdom’s index were your personal favorite, apologies guv’nor!

What moved? In a word: China.

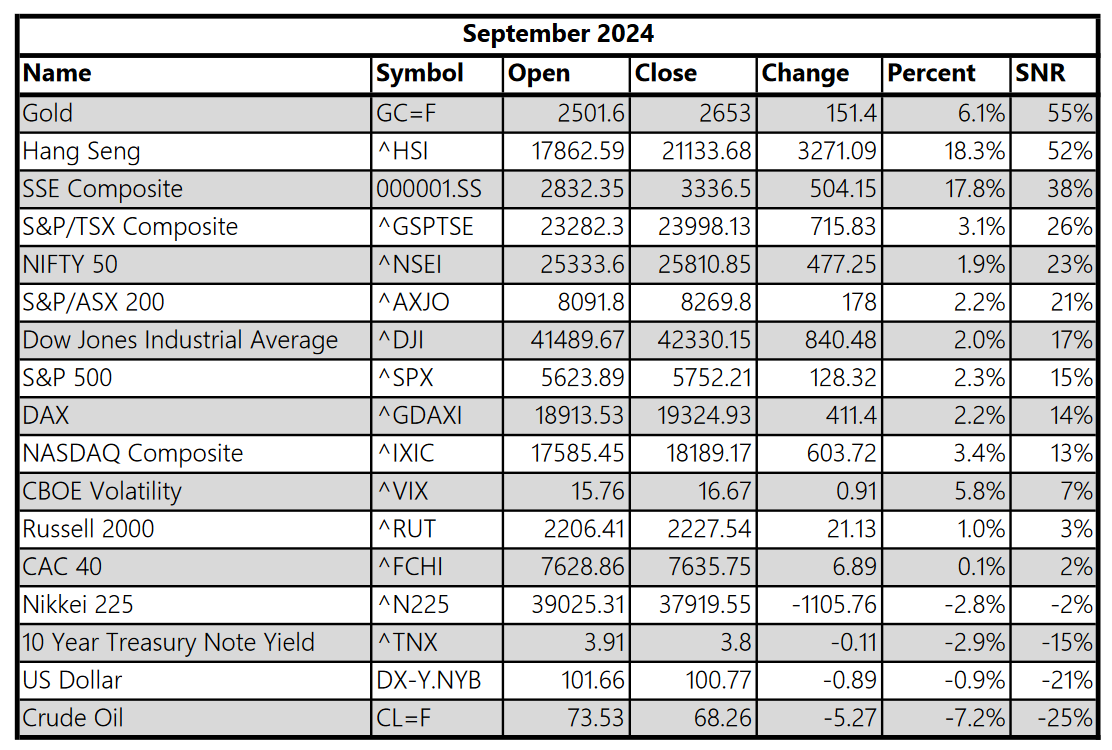

The Hang Seng and SSE Composite indexes exploded higher, gaining a massive +18% on the news that the Chinese financial regulators would begin stimulating their floundering equity markets. I have been watching several Chinese companies, but currently do not hold any positions in them. This appears to be a promising development, but I’m not an expert on Chinese markets, to say the least.

Gold gained +6.1% in the most definitive positive move this past month. This serves as an interesting contrast to crude oil, which fell -7.2% in the most definitive negative move. This divergence could be pointing towards deflationary fears in the market.

While oil is signaling continued disinflation, gold investors aren’t convinced of that signal. They would rather move into the safety of gold if there’s a deflationary slowdown in the economy. Otherwise, these prices tend to move in tandem if it were simply an indication of inflation.

Look to the 10-year yield for further evidence of a flight to safety. Investors are buying, pushing yields well below 4%. Think about the slew of harbingers this month: the Fed cuts rates, oil prices plunge, long-term bond yields are shriveling up, and the gains in gold continue.

Hypothetically, if I’m still mostly invested in mega-cap U.S. equities, which have performed remarkably well since October 2022, I could be looking to rotate into long-dated bonds while there is still yield to capture, gold before even more of its performance escapes me, or now even Chinese stocks as they appear to be bottoming.

In reality, I don’t believe these are the best investment vehicles to rotate to, but this is what the typical equity investor could be thinking right now.

ChatPYT

The Oracle of Delphi, Pythia, has held a shrine in the Temple of Apollo since at least the 8th century BC, amassing followers who looked to the priestess for divination. Today, we have a similar fascination with artificial intelligence (AI), a computational black-box model that interests us for its divination-like qualities.

Let’s ask ChatGPT about what it “thinks” of the current setup:

What economic condition could this be signaling: US dollar moving down, 10-year yield moving down, crude oil prices moving down, gold prices moving higher, US equity markets roughly flat, foreign equity markets moving higher?Its response:

This combination of economic signals could indicate several underlying conditions:

Deflationary Pressures: The falling crude oil prices and 10-year yields suggest concerns about lower inflation or even deflation. Investors might be expecting economic slowdown, leading to reduced demand for oil and lower yields as they seek safe assets.

Safe-Haven Demand: Rising gold prices alongside a declining dollar can indicate a flight to safety, as investors seek gold as a hedge against economic uncertainty or currency devaluation. This could be driven by fears regarding the US economy or geopolitical concerns.

Weakening Dollar: A declining dollar can make gold more attractive to foreign investors and can also imply a lack of confidence in US monetary policy or economic prospects, contributing to the rise in gold prices.

Mixed Equity Market Sentiment: The US equity markets being flat while foreign markets rise might reflect a divergence in economic outlooks. Investors could be rotating into international equities due to better growth prospects elsewhere or due to relative valuations.

Overall, this scenario could signal a cautious outlook for the US economy, with potential concerns over growth, inflation, and the effectiveness of monetary policy, while at the same time reflecting a search for safe-haven assets like gold amid a more favorable environment for foreign equities.Thus, the oracle has spoken. Ignore her “wisdom” at your own peril!

Jokes aside, compare my perspective to that of the AI’s and you’ll find that we’ve highlighted similar concerns with the current financial landscape. It’s only a snapshot though, and we could always be wrong in our interpretation of the data.

Personally, I’m not betting against this particular divination.