Questionable Foundations

Does bank credit support the equity market?

In this week’s article, we take a quick look at one of my favorite spreads.

Total Bank Credit

If you have ever spent time browsing financial data sources, then you might know the joy of finding an absolute gem of a timeseries. Think of it as the nerdy equivalent to finding an amazing vinyl record in a secondhand store. From the Federal Reserve, we have a little goodie called “Bank Credit, All Commercial Banks” (TOTBKCR).

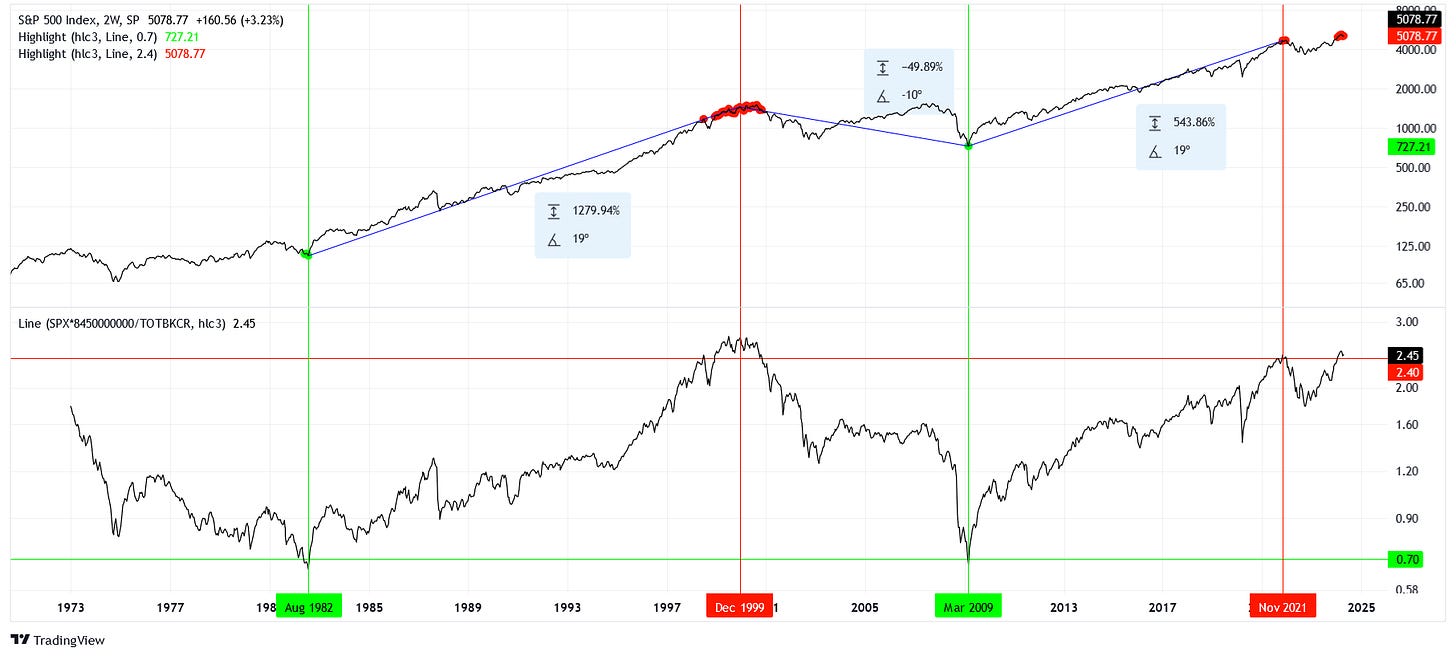

The real joy is what happens when we take the scaled S&P 500 cash index (SPX) and divide it by total bank credit.

The scaling factor may seem arbitrary, but it turns the SPX into an analog of the total market capitalization of the U.S. equity market. Essentially, we are comparing the total value of the stock market to the total value of U.S. bank credit.

Notice that we have five decades of history and that our spread is bound between values of about 0.67 to 2.75. This means that at some times there is more value in bank credit and at other times there is more value in stocks. We can think of bank credit as money. The more credit banks extend, the more dollars are in the economy.

Right now, there is a lot of value in equity assets relative to bank credit.

Scope In

Let us use another chart to mark up the SPX and highlight it against this spread.

The reason this spread is so powerful is that it manages to capture the range of markets highs and lows with a flat trend and a constant range.

The generational buying opportunities of 1982 and 2009 stand out extremely well on this spread. Similarly, the extended market of 1999 shows up nicely at the top of the range. Unfortunately, we do not have the late 1960s on this chart. That history may have confirmed the range high alongside the Dotcom bubble.

In late 2021 this spread reached the top of its range, dipped down in 2022, and now we’re back above 2.4 in 2024. For every dollar in bank credit, there are 240 cents in stock market value. Contrast this with a 1982 or a 2009 where for every dollar in bank credit there was only 70 cents in stock market vale.

Conclusions

The value of stocks has outpaced what fuels our economy: credit. What is the solution? Either a decrease in the price of stocks or growth in household debt.

Pick your poison.