The Game of Investing

Quid pro quo.

This post marks the beginning of a series of weekly educational articles that cover a spectrum of topics, from general advice to specific technical knowledge. I hope you find them useful.

Investing is Security

Why invest at all? After the recent wave of inflation, the answer should be clear.

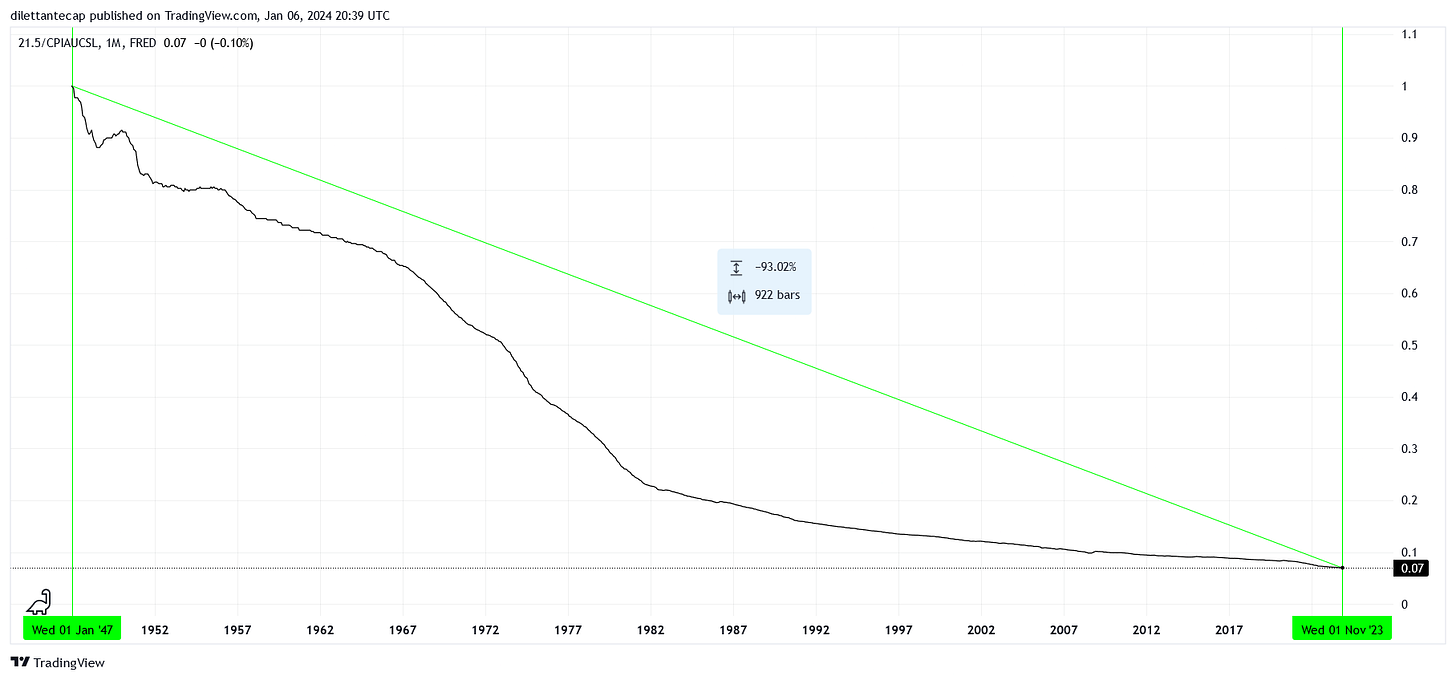

The Federal Reserve maintains a long-run inflation target of 2%. For you, this means that if your money is stashed in a bank, its original value is slashed in half every 35 years. The Bureau of Labor Statistics reported an average inflation rate of 3.71% from 1944 to the present - not just a target, but a measured reality, implying that your money's purchasing power is halved every 19 years.

Delving deeper, analysts like John Williams suggest recent inflation rates are underestimated twofold. Assuming this holds true, we might consider an inflation rate of 5.04% since 2002. In this scenario, the value of your money is halved every 14 years.

Whether it takes 35 years or 14 years for your money to lose half of its value, prioritizing your buying power should be key. After all, why work hard if you cannot safeguard its fruits?

Investing is a Game

One way to think about investing is as a game of "this for that."

Imagine you want to buy a medium-sized cup of black coffee from Starbucks. This would cost you $1.55 in 2001 and $2.45 in 2020. Notice that the simple act of buying coffee can be thought of as a pair trade. I receive one cup of coffee if I provide two and a half dollars. If we invert the trade, we can better understand the pair. One dollar costs 0.645 cups of coffee in 2001 and 0.408 cups of coffee in 2020. To put it another way, the value of coffee has outperformed the value of the dollar by +58% in this period.

What does this have to do with investing?

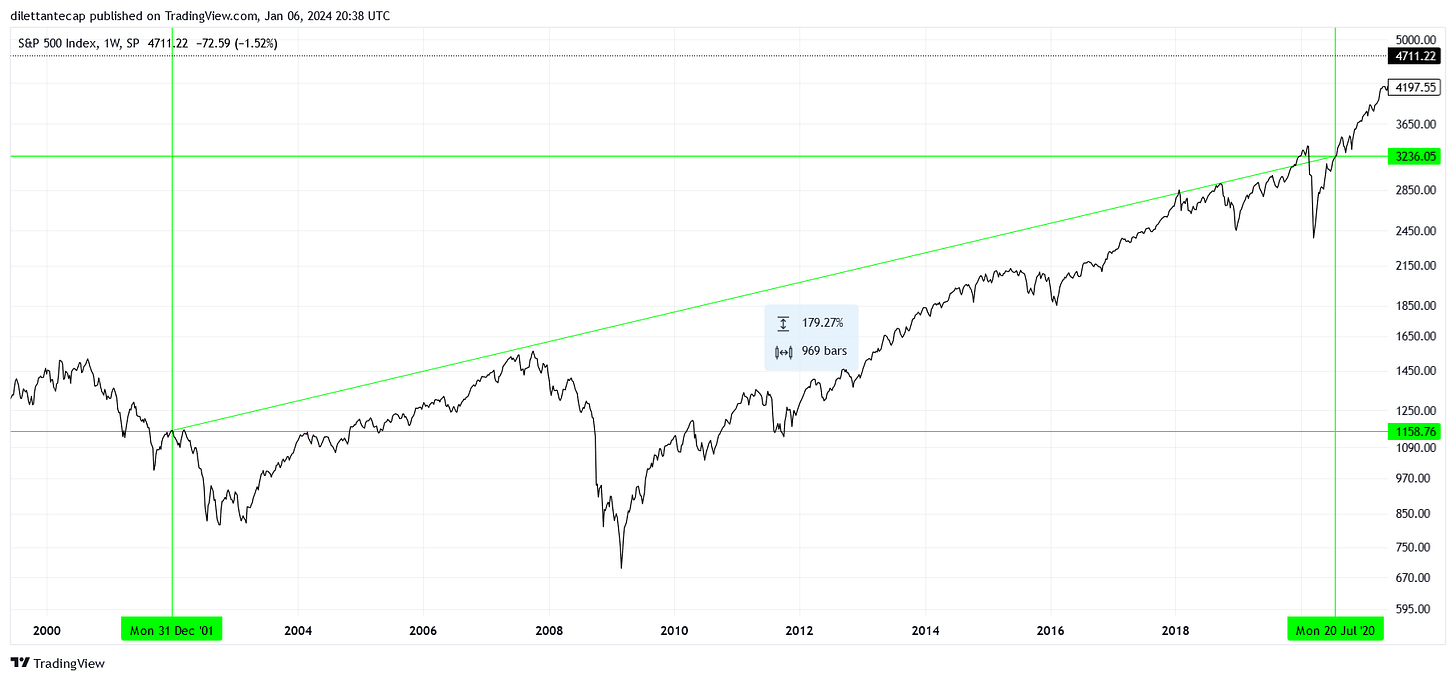

Instead of storing our wealth in dollars, we can own something that will be more desirable in the future. Take the S&P 500 index as an example. This index measures the summed market capitalization of the 500 largest public U.S. companies. You could have purchased one contract of the S&P 500 cash index for $1158.76 in 2001 and for $3236.05 in 2020. We can invert the trade once again to better understand the pair. A thousand dollars cost 0.863 contracts in 2001 and 0.309 contracts in 2020. As a percent change, the value of the S&P 500 market index outperformed the value of a dollar by +179% during this period.

By being invested in the market from 2001 to 2020, we could have had 2.79x more dollars than if we simply held onto them. With an inflation rate of 3.71%, the purchasing power of the dollar would be halved over the same period, so we can equate this to a 1.4x increase in general purchasing power by being invested. Lastly, our Starbucks example indicates a 1.77x increase in the number of cups of coffee because of the investment.

Whether discussing dollars, general buying power, or Starbucks coffee, investing in U.S. equity markets from 2001 to 2020 increased our purchasing power for all the mentioned "assets." Purchasing power cannot be owned directly, making it less of an asset and more of a useful benchmark. Regardless, the game of investing not only shielded our wealth from losing value but increased its worth!

Investing is Opportunistic

Within a pool of assets, investors aspire to hold the one that will outperform all the others in the future. The trick is knowing which asset that is.

Popular asset classes include equities (stocks), fixed income (bonds), cash and cash equivalents, real estate, commodities, cryptocurrency, private equity, foreign exchange, and derivatives. Each category holds myriad individual assets. Stocks, for instance, allow ownership of shares in public companies like Apple, Walmart, and Chevron. The diverse array of sectors, industries, and companies in stock alone offers a lifetime of study. Commodities expose you to everything from crude oil to copper to lean hogs. Bonds provide a way to earn steady cash flow over time with minimal risk of losing the principal investment. While derivatives may not suit beginners, they enable expression of almost any investment idea.

Whether you are starting out or an experienced investor, it pays to search broadly. Many investors specialize as they gain experience, but opportunities exist in all markets simultaneously. Imagine being at your desk on April 20th, 2020, when WTI crude oil futures went negative. If you deliberately never trade commodities, you would miss out on a once-in-a-lifetime opportunity! While specialization remains crucial for the average investor, having a basic understanding of other markets proves beneficial when unexpected windfalls present themselves.

Regardless of the market you decide to play, remember, your mind is the ultimate asset. Stay curious, tread carefully, and keep playing. The game of investing is played all the time, all over the world. What will your next move be?