This Is It

Signs of the time.

In this week’s article, we review some risks.

Futures

Dealers are smart, managers are dumb.

If we were to create a formula in TradingView to embody this hypothesis, it might look like the following:

We calculate the square root of the ratio between the product of manager longs and dealer shorts, compared to the product of manager shorts and dealer longs. The result is a ratio that indicates how bullish the “dumb money” is.

For example, this ratio is currently 7.2x, meaning there are 7.2 bullish “dumb” trades for every bearish “smart” trade.

This ratio is as high as it has ever been in its history, dating back to 2006.

With so much dumb money piled long, should we be buying the market here?

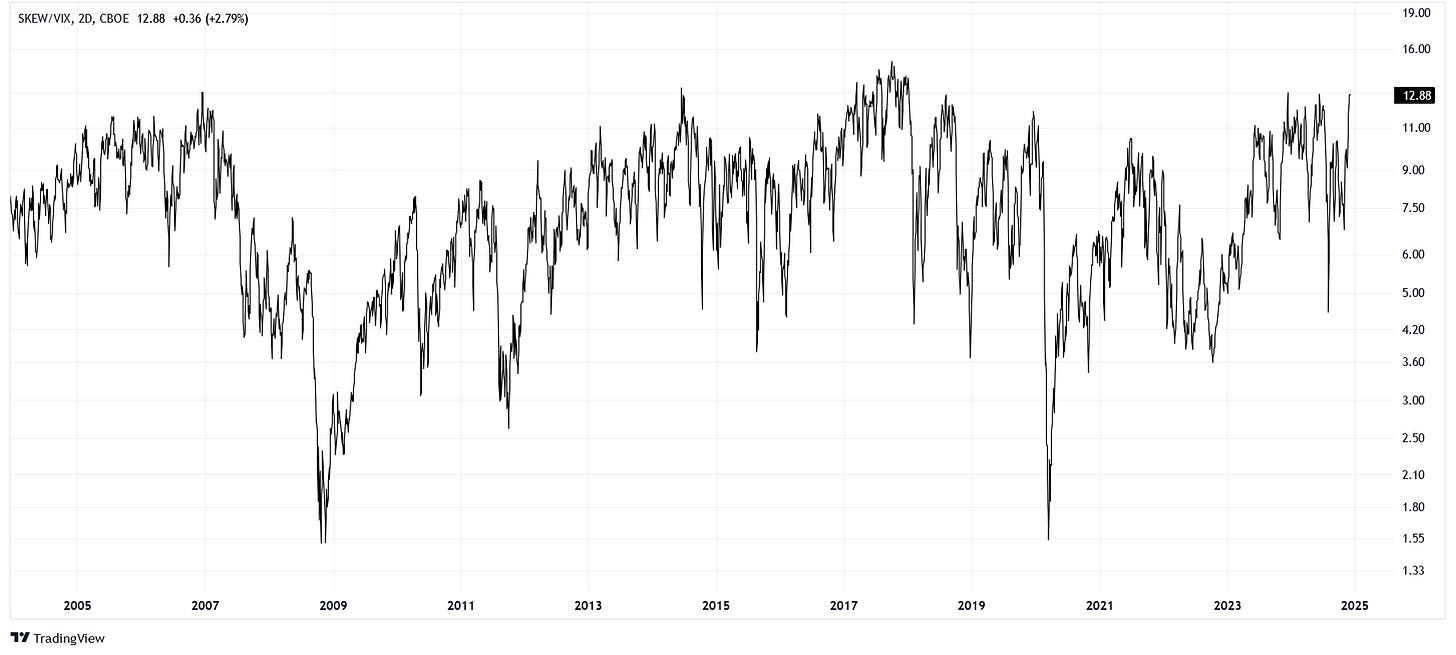

Options

The VIX reports the absolute 30-day volatility priced into options, while the SKEW indicates the direction in which these options are being priced. Typically, the VIX is low when the SKEW is high, so we can take their ratio for a combined interaction.

We observe that this ratio is near the top of its range, surpassed only by bullish options positioning at the end of 2017.

If the majority of the options are betting for the market to continue its upwards momentum, should we expect the same?

Credit Spreads

Corporate bond spreads are calculated by taking the difference between yields on corporate bonds and yields on the risk-free alternative (Treasuries).

Fortunately for us, Bank of America already calculates this, so all we need to do is refer to the proper series.

To find a level lower than what we observe today, we would have to go back to March 2005. Needless to say, this is a historically tight spread.

If corporate bonds cannot be expected to pay much over Treasuries currently, should we expect earnings payouts from corporations to be much better?

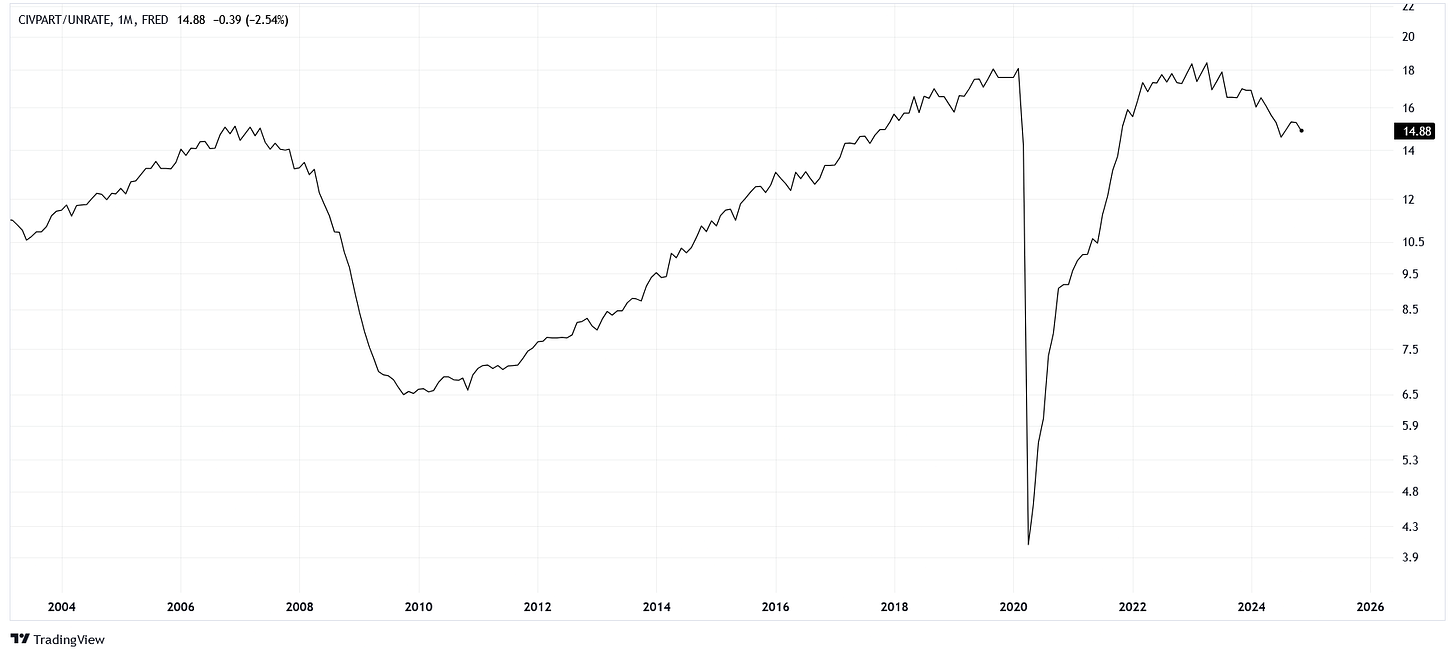

Labor Market

In addition to the unemployment rate, we also consider the civilian labor force participation rate. By taking the ratio between these two, we get a clearer picture of the labor market as a whole.

From 2019 to about 2023—excluding the COVID period—the labor market has been historically tight, meaning many people are active in the workforce. Such tight labor markets have only occurred in the early 2000s and the late 1960s.

If job losses continue and individuals need to fund their loss of income, can we expect them not to sell their wealth tied up in stocks?